URGENT UPDATE–There is a specific pattern and trading approach we use that has been bringing in huge wins. In fact we used it in last weeks article to highlight a trade that offered a 136% win. I am going to do a live training session on this combination on Monday, Oct 27 at 1pm and show why it is doing so well. This is where to reserve your spot.

Let’s start the week out by looking at trade examples in the SPY. We’ll take a look at what is going on this morning, a great indicator that is effective in this situation, and why the SPY is an excellent choice for trading options. At the bottom of this email, I even include an update on a previous example.

SPY, or the SPDR S&P 500 trust was one of the first exchange traded funds and is also one of the most traded ETFs. That volume makes it ideal for great trades. SPY tracks the S&P and makes it possible for individual traders to trade moves in the entire index.

Look at what the S&P did on Wednesday to help us get an idea of what to expect from the SPY this week. The image below is yesterday’s price activity.

This chart image is courtesy of FINVIZ.com a free website and gives a quick view of each day’s movement. Understanding the direction, the S&P was moving on the previous trading day is a great place to start.

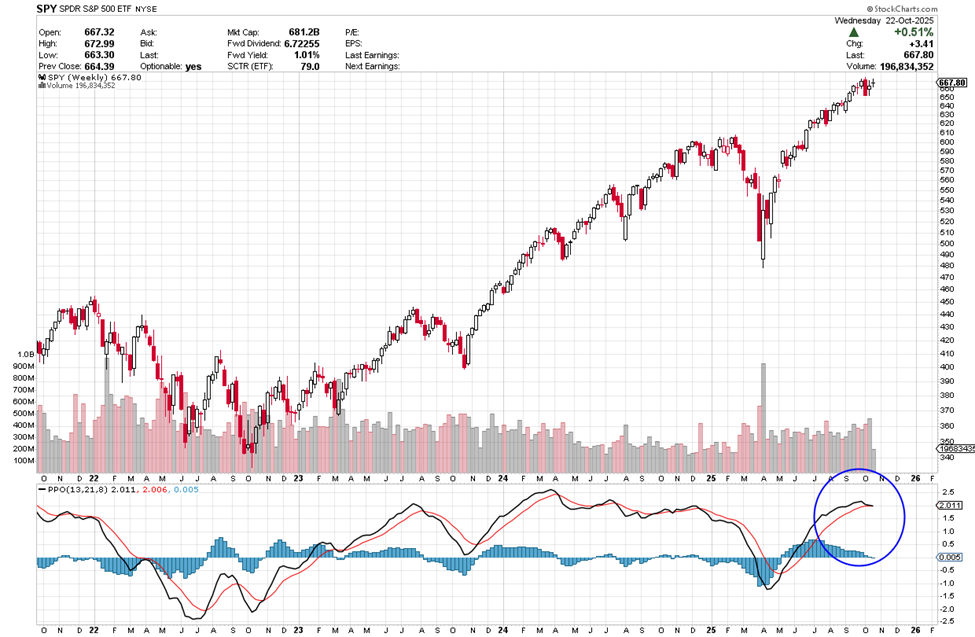

Next, let’s look at chart that includes the Percentage Price Oscillator or PPO indicator. We are specifically looking at the lines in the PPO to cross but you can get more information about this indicator here.

The black line of PPO running right with the red line. They appear to be curling down. This likely indicates that SPY is headed into bearish territory.

Potential SPY trade:

In this example, if the price continues to FALL you could consider a PUT trade if it goes BELOW $667 The short-term target is $660.

Here’s Why an Option Offers A Big Potential Payout

The stock price in this example is $667.80.

If you were trading options and selected a PUT option strike, you would pay a premium of around $7.76 for the Nov 21st 660 expiration. This is an investment of $776 for the 100-share option contract. If the stock price moves to 660 the premium is apt to go up to about $3.50. Your premium of $776 plus $350= $1126. That is a profit of 45% over a short period of time.

Remember, you can take profit anywhere along the line, you don’t have to wait for the expiration date to sell. It is often wise to take profit when it is earned, especially in a volatile market.

Stay positive and know you can do this. Knowing creates positive results! A part of the abundance process is letting go of anything negative, which creates space to receive.

I wish you the very best,

Wendy

Previous Trades:

Last week we discussed buying SPY puts. On 10-16 the Nov 21st 658 put was $6.34. You could have sold on $14.98, a 136% profit.

Recent Comments