Earnings season is kicking off this week, and the big players are getting positioned. Even though the market isn’t in any type or high probability area for fresh longs, one still has to favor that dips will be bought. In this regard I continue to like AAPL for higher prices.

On the downside TSLA did give us a short signal a week ago, but its lack of sellers thus far is another indication that buyers are still running the market. If TSLA moves much higher it’s going to give a buy signal, which if it does I would be inclined to follow and get long — if there are no sellers then the pullback was just a chance to get long in TSLA. I am not yet long AAPL but good chance I will do so early in the week, if we can dip a bit. TSLA is on my radar as a litmus test, and if it moves higher, don’t short the stock market.

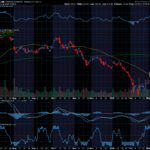

Still long DEVON ENERGY. Thus stock has required patience but it is moving my way. It an interesting situation presently where Crude, Gold and Stock all look bullish simultaneously.

Thanks,

Joe

Recent Comments