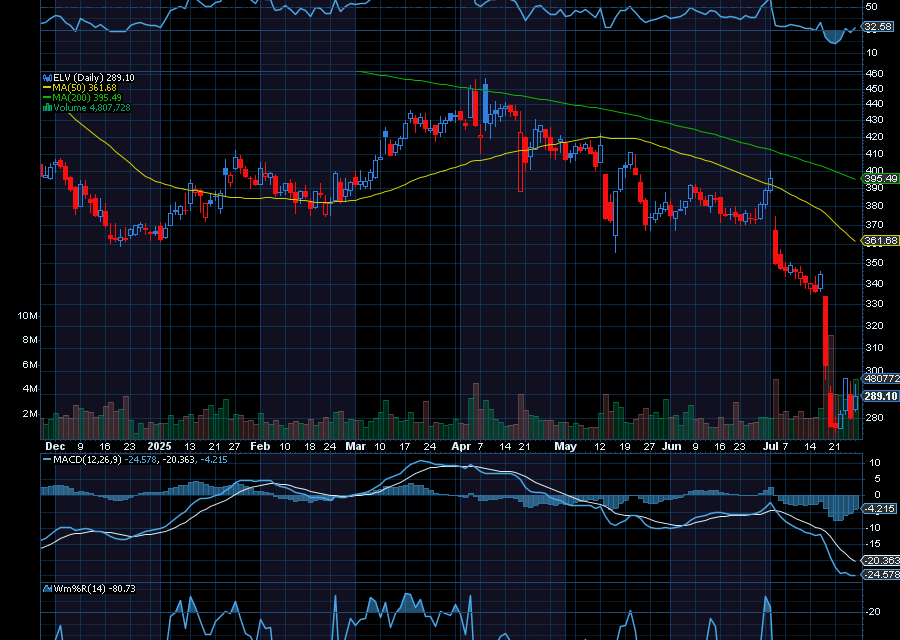

Keep an eye on Elevance Health (ELV).

Over the last few days, the stock gapped from about $340 to a low of about $274.40. That was after the health insurer cut its guidance.

According to the company, elevated cost trends in the Affordable Care Act exchanges and Medicaid market forced it to revise its forecast for adjusted net income of $30 per diluted shares from a range of $34.15 to $34.85, and as compared to estimates of $34.15.

“This reset reflects the same pressures that others in the sector have now confirmed, particularly elevated medical cost trends across ACA and slower-than-expected Medicaid rate alignment,” said President and CEO Gail Boudreaux, as quoted by Seeking Alpha.

Analysts at Argus downgraded the stock to a hold because of pressure on profit margins.

However, it appears most of that negativity has been priced into the massive pullback. Plus, on the day of the pullback, CEO Boudreaux paid $2.4 million for 8,500 shares at an average price of $268.94 per share. Boudreaux last bought shares in 2020, paying $2 million for 7,600 shares.

Sincerely,

Ian Cooper

Recent Comments