Artificial intelligence-related stocks could see a significant boost from President Trump’s new AI Action Plan. Released by the White House on July 23, the Administration’s AI Action Plan and three Executive Orders to accelerate US leadership in artificial intelligence.

That new plan outlines priorities in innovation, infrastructure, and international AI exports, while the orders mandate ideologically neutral AI in federal use, fast-track data center development, and promote global deployment of US AI technologies.

As noted in The White House report, “AI will enable Americans to discover new materials, synthesize new chemicals, manufacture new drugs, and develop new methods to harness energy—an industrial revolution. It will enable radically new forms of education, media, and communication—an information revolution. And it will enable altogether new intellectual achievements: unraveling ancient scrolls once thought unreadable, making breakthroughs in scientific and mathematical theory, and creating new kinds of digital and physical art.”

One of the top companies that should benefit is Nvidia (NVDA).

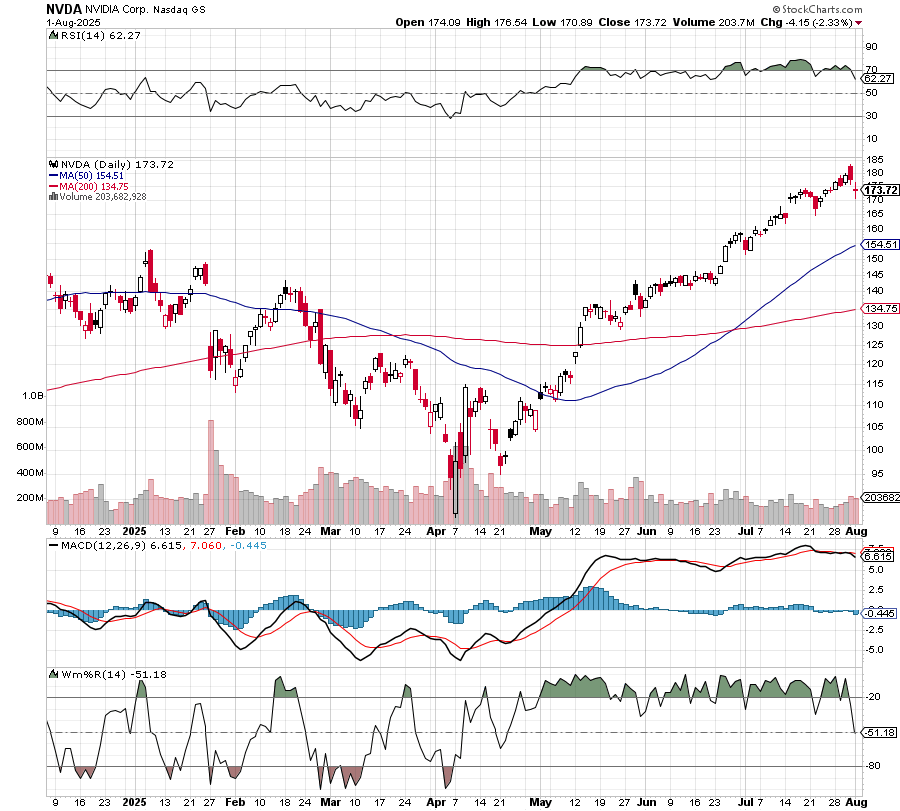

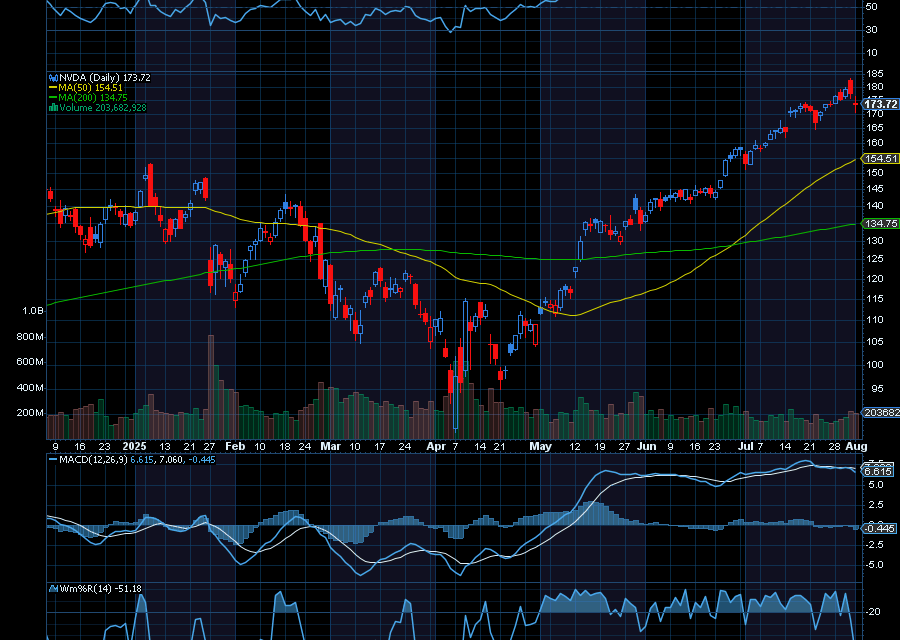

One of the most well-known AI companies in the world is Nvidia, a $4.29 trillion powerhouse whose stock rallied from an April low of $86.61 to a recent high of $183.30.

The tech giant is seeing incredible growth, driven largely by its dominant AI position. For one, its GPUs are now crucial for training and running complex AI models. Two, it holds a dominant position in the data center GPU market. In fact, we can see that data center growth in its first quarter earnings report, which noted 73% data center revenue growth year over year.

In April, the company posted: Q1 EPS of 81 cents, which beat estimates by six cents. Revenue of $44.06 billion, up 69.2% year over year, beat by $810 million.

In addition, companies like Microsoft and Meta just said they would boost their capex to grow their AI capacity, which helps fuel stocks like NVDA. Bank of America reiterated its buy rating on NVDA, noting, “Despite unwelcome but now largely expected EPS reset, we find stock compelling at 29x our CY25E EPS and given unwavering support for mission critical AI infrastructure investments/even raised capex by major U.S. cloud customers.”

Sincerely,

Ian Cooper

Recent Comments