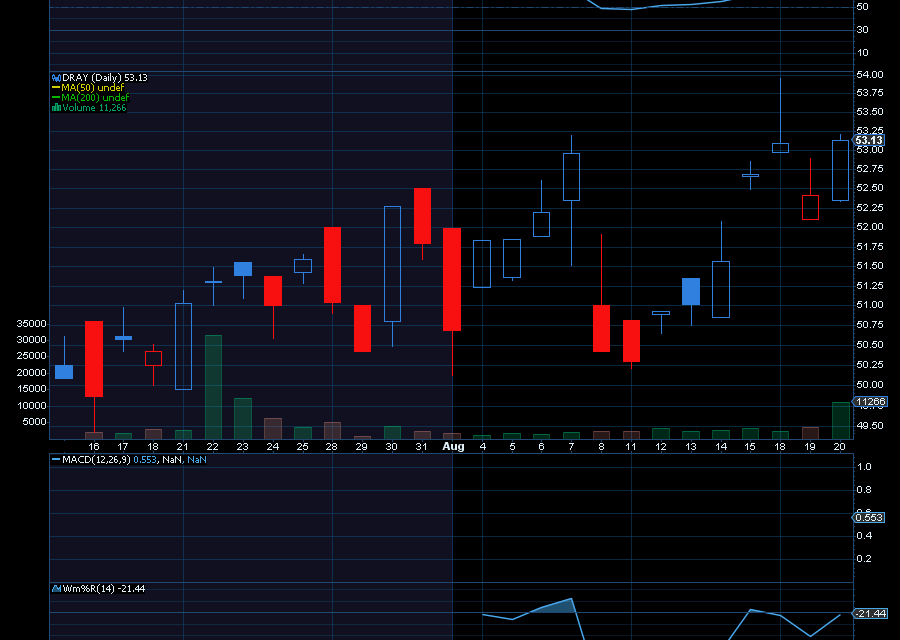

With an expense ratio of 0.99%, the YieldMax DKNG Option Income Strategy ETF (DRAY) started trading on July 15 at $50.25. Now up to $52.41, it’s just starting to gain traction, especially with millions of Americans set to place their bets on the 2025 NFL season.

While the fund does not directly invest in DraftKings, it does generate monthly income by selling/writing call options on DKNG.

Fueling upside for DKNG is the 2025 NFL season.

A year ago, the American Gaming Association said Americans were expected to spend about $35 billion on NFL games this year. That’s up from the $26.7 billion wagered a year prior.

At the time, as noted by CBS Sports, “The NFL remains king, and more money is wagered on the NFL than any other league. The NFL also attracts six-figure wages (and sometimes seven-figure wagers) on a regular basis throughout the season.”

From its August 2024 low of $28.69, DKNG ran to a high of about $53.61 shortly after the 2025 Super Bowl. With the 2025 NFL season about to kick off, we do expect to see similar returns for DKNG, which would positively impact the DRAY ETF.

While DKNG did post Q2 EPS of 38 cents, which missed by three cents, revenue of $1.51 billion (up 37.3% year over year) beat by $80 million. “We set records for revenue, net income, and adjusted EBITDA in the second quarter, driven by an acceleration in revenue growth to 37% year-over-year,” said CEO Jason Robins, as quoted by Seeking Alpha.

Even better, analysts are bullish.

BTIG analysts, for example, reiterated a buy rating on DKNG with a $53 price target. Macquarie analysts raised their price target on DKNG to $55. Needham analysts reiterated a buy rating.

Sincerely,

Ian Cooper

Recent Comments