Keep an eye on lithium stocks, like Albemarle (ALB).

About two weeks ago, related stocks jumped on reports that battery maker Contemporary Amperex Technology suspended production at a mine in China, which plays a key role in supplying the global market.

“The mine in question produces about 4% of global lithium supply forecast for 2025, according to Morgan Stanley. The lithium supply and demand balance was already tightening, with a small surplus expected in 2025,” reported CNBC.

On that news, the Sprott Lithium Miners ETF (LITP), for example, jumped from about $6.53 to a high of $8.44. While the ETF did pull back slightly as the news cooled, investors may want to use its temporary weakness as a buy opportunity.

That’s because analysts at UBS just warned that supply disruptions out of China would continue for longer than expected. “UBS analyst Levi Spry published a note on Tuesday which said the investment bank’s China team had now concluded that the CATL mine could be closed for 12 months because of the ongoing licensing issue,” as reported by the Financial Review.

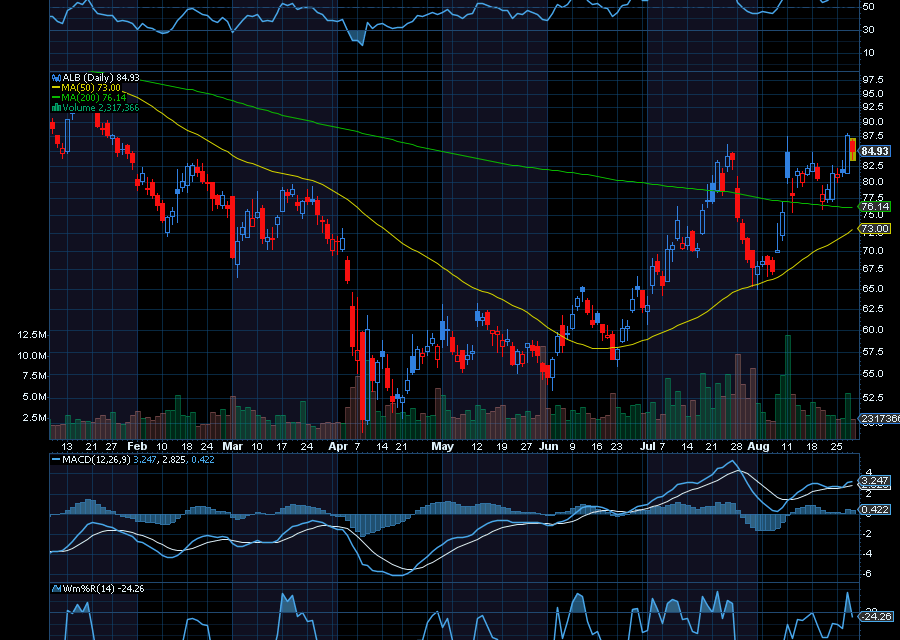

That being said, investors may want to keep an eye on Albemarle.

After finding support at $50 in April, Albemarle is now up to $84.40.

From here, we’d like to see the lithium stock raced back to $95 initially. While we wait for that to happen, we can collect its 1.91% yield. Analysts at UBS just upgraded ALB to a neutral rating from a sell rating, with a price target of $89.

With the latest China supply issue, UBS analysts now “sees a base case for lithium prices rising more than 20% Y/Y in 2026, so with lithium prices potentially moving higher in the near term, and prices either temporarily or structurally higher than the prior base case,” as reported by Seeking Alpha.

Sincerely,

Ian Cooper

Recent Comments