Welcome back to Traders War Room!

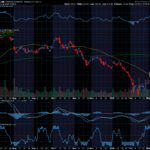

Markets are at a pivot point. Inflation just jumped to 2.9% in August, the hottest in seven months, while job growth slowed sharply. That mix has Wall Street betting the Fed may cut rates at next week’s meeting, but nothing is guaranteed. For traders, that means volatility and opportunity.

Here’s what matters: Growth stocks and rate-sensitive names have been whipping around as bond yields swing. If Powell signals a cut, expect tech, small caps, and beaten-down growth plays to catch a bid. On the flip side, if the Fed holds steady, look for strength in financials, energy, and defensives as traders reposition.

- Options trades like straddles can capture the big swings on Fed day.

- Sector rotations are likely to accelerate, so keeping an eye on ETFs like XLK (tech) or XLF (financials) could be key.

- Short-term trades may be smarter than long holds right now. High-beta stocks will move fast, and tight risk management is essential.

The bottom line is the Fed’s decision won’t just move rates, it will reset stock market momentum. Traders who position early and stay nimble could catch the next breakout.

Stay sharp and stay ready. This is where smart trading pays.

Happy Trading!

Recent Comments