One of the best ways to build wealth is by investing in down, but not out stocks, which also carry hefty dividends. Not only can you make money as you wait for the stock to recover, but you can also benefit from high dividend returns along the way.

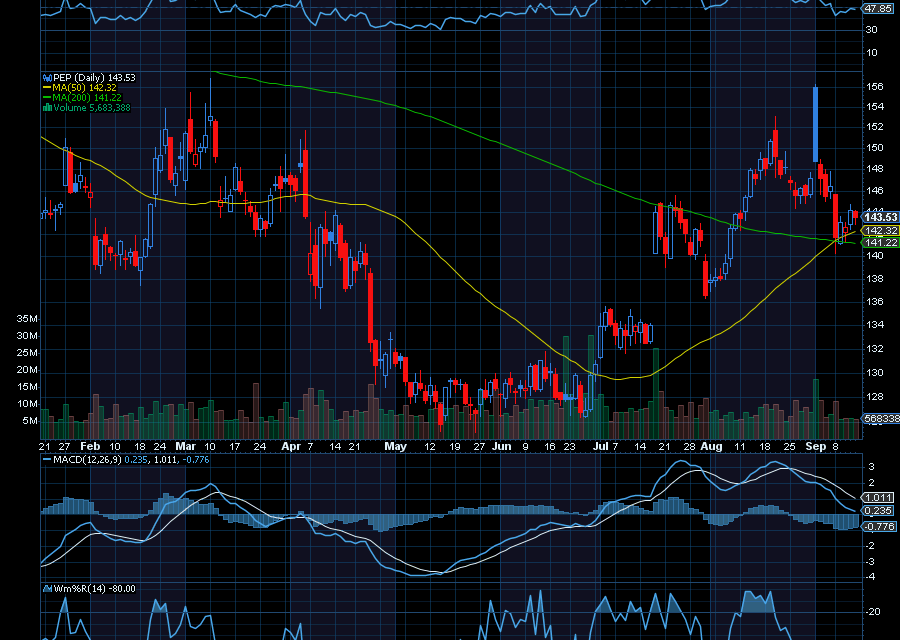

Look at PepsiCo (PEP), for example.

With a yield of 3.95%, PepsiCo is just starting to pivot higher after dipping to $140 a share. Now at $144.23, we’d like to see PEP retest $155 near-term.

Even better, PEP just declared a quarterly dividend of $1.4225, which is payable on September 30 to shareholders of record as of September 5. This now marks the company’s 53rd consecutive annual dividend increase since 1965.

Helping, analysts at TD Cowen raised their price target on PEP to $155 after Elliott Management took a $4 billion activist stake in the food and beverage stock.

“PepsiCo today represents a rare chance to revitalize a leading global enterprise and unlock significant shareholder value,” added Elliott Management, as quoted in the firm’s letter to PepsiCo’s board.

Sincerely,

Ian Cooper

Recent Comments