With a yield of 3.21%, oversold shares of Southern Co. are on sale.

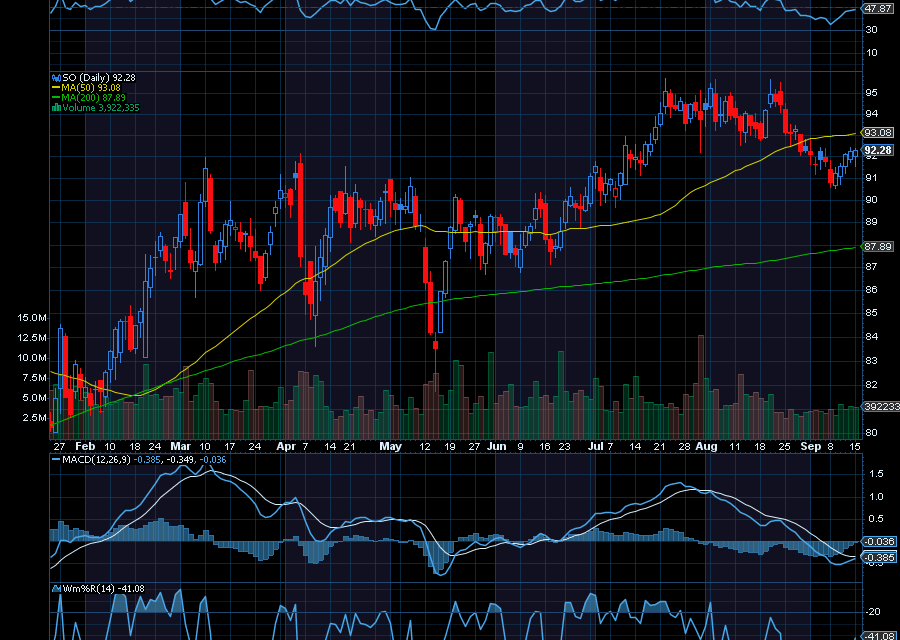

Over the last few weeks, SO fell from about $95.64 to a recent low of $90.53. Fueling some of the pullback, analysts at Wolfe Research downgraded the SO stock to peer perform, as it traded at a 25% premium to the utility average 2026 earnings multiple.

With negativity now priced into the SO stock, we’d like to see it rally back to $95 initially.

In addition, with an unstoppable artificial intelligence boom, we’ll see a bigger need for data centers, which will benefit companies like Southern Co. As noted by Wells Fargo, after years of flat power growth in the U.S., electricity demand could grow as much as 20% by 2030. Again, because of the AI data center demand.

Analysts at Morgan Stanley also raised their price target on the stock to $94 from $92. Analysts at Mizuho also raised their price target on the stock to $95 after Southern Co raised its five-year capital plan by $13 billion to $76 billion.

Sincerely,

Ian Cooper

Recent Comments