Amcor is a global leader in developing and producing consumer packaging and dispensing solutions across a variety of materials for nutrition, health, beauty, and wellness categories.

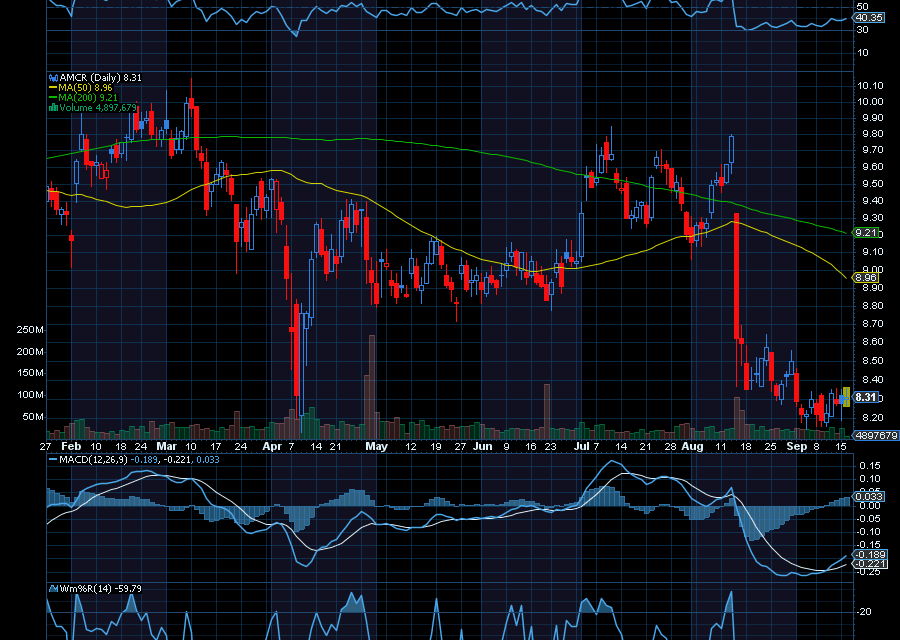

Most recently, the stock slipped after missing on top and bottom line estimates. EPS of 20 cents was missed by two cents. Revenue of $5.08 billion, up 43.5% year over year, missed by $100 million. However, the stock appears to have priced in the miss, catching support at $8.33.

Making it even more attractive, the company will pay a quarterly dividend of $0.1275 on September 25 to shareholders of record as of September 5.

Plus, analysts at Goldman Sachs just initiated coverage of AMCR with a buy rating, noting that “While the company’s demand backdrop remains challenging, Amcor’s valuation at current levels provides support,” as quoted by Tip Ranks.

Last trading at $8.31, we’d like to see AMCR race back to $9.60 initially.

Sincerely,

Ian Cooper

Recent Comments