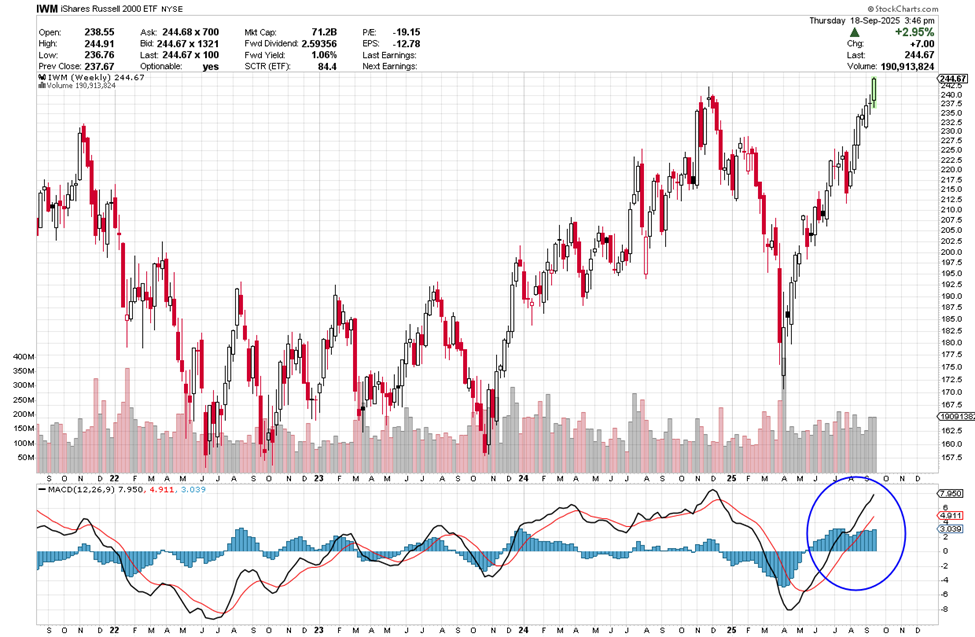

What I observed on my charts this morning reinforced something I’ve been telling traders for years: Keep your trading simple. The chart below shows a setup I found in IWM. This ticker is special and works like a Swiss Army Knife in trading—sometimes, it’s all you need. When I spot this pattern, I know the odds are stacked in my favor.

Time is one of your most valuable assets. Think of what you can spend it on. Family, vacation, learning, or simply relaxing.

If you want to save more time AND get great trades (like the example from last week that hit near a 100% gain) check out my One-Ticker Income Plan. It completely simplifies trading by using a single ticker. Take a look at how it works and how pleased other traders are who are using it.

The great thing is you don’t have to sift through thousands of tickers to find this setup, plus you get exposure to a diverse range of stocks. When I see the pattern on the MACD (Moving Average Convergence Divergence) indicator (more on that here), I consider a CALL based on the black line is above the red line, signaling movement to the UPSIDE. When I look at the candles, they are very flat, indicating it may be consolidating. I usually prefer buying a CALL at least a month or even two months out, allowing time for the move to develop. The MACD might indicate a potential move, but it can take some time to unfold.

Don’t get discouraged if a trade doesn’t play out as expected. The market doesn’t always move smoothly, but with persistence and the right tools, like the MACD, you’ll be able to reach your trading goals, even in challenging conditions.

I wish you the very best,

Wendy

Last week we discussed buying calls. Profit on the trade would have been near 100%.

Recent Comments