Right now the demand for flight, logistics, and power infrastructure is rising across the board. When this occurs, the companies that build the engines behind that surge tend to hide in plain sight—until momentum amplifies and starts showing on the charts. Right now, one of those names is stepping into focus. Massive backlogs of aircraft orders, accelerated engine deliveries, and a booming aftermarket services cycle are fueling a resurgence of earnings and cash flows in the aerospace supply chain. The firm is investing heavily in maintenance, repair, and overhaul (MRO) capacity to meet the load and support long tail revenues. All signs point to a perfect storm: fundamentals, backlog, and technical strength aligning. The chart is among the best I’ve seen this year and this breakout is exactly the kind I want to be highlighting for YOU—because it looks like the upside is just beginning.

The company I’m focused on is GE Aerospace (GE)—a powerhouse in jet engines, aviation systems, and aftermarket services that has become one of the Street’s favorite momentum plays. Investors are piling in because the story here isn’t just about cyclical recovery—it’s about multi-year, secular demand tailwinds. Airlines are racing to modernize fleets, global travel is rebounding at full throttle, and GE’s engines are locked into record order backlogs that stretch years into the future. Add in the high-margin service contracts tied to every engine sold, alongside management’s sharpened focus on cash flow discipline and operational efficiency after the spin-off, and it’s easy to see why sentiment is so strong. Momentum is accelerating, the fundamentals are reinforcing the move, and traders are taking notice as the stock continues to power higher with conviction.

‼️Attention Investors and Traders! Curious about Chuck Hughes? Discover the secrets behind 23 profitable years in a row. Get this Ebook now to get started! 💡

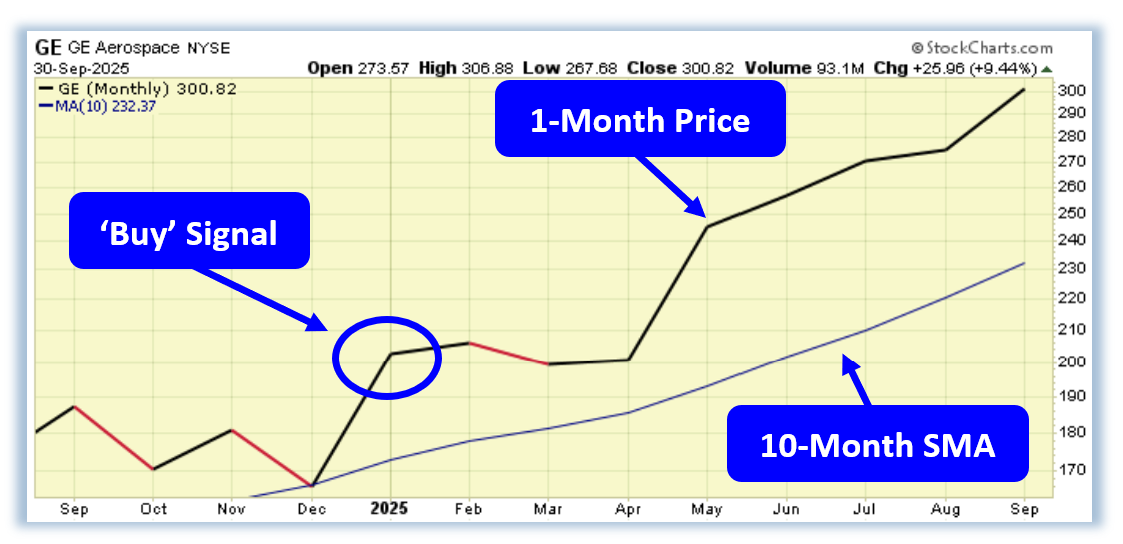

What truly pushed this stock onto my Buy List wasn’t just the backlog headlines or the industry tailwinds—it was the charts and technical alignment that screams momentum with durability. The charts just flashed a Powertrend ‘Buy’ signal, with the stock’s 1-month price surging above its 10-month SMA. This is one of my favorite signals to track because it tells me that short-term momentum is decisively overpowering long-term trends—a hallmark of breakouts that don’t just pop and fade, but have staying power. It’s the kind of setup that signals institutions are leaning in hard, locking in exposure, and fueling a move that could keep driving higher for months. When a stock is already trading above all major moving averages and layering on a the Powertrend trigger like this, I don’t see hesitation—I see a chart that’s telling traders, in bold letters, “the bulls are in control.”

For this setup, it’s not exactly the type where I’d look to trade it with just an option purchase. I’d instead look to trade this one with an ITM call debit spread. Why? Because while the stock’s momentum and technicals are strong, I want some downside protection built in should we see a short-term cooling after the sector’s recent run. The options market here is loaded with premium—rich pricing that I can actually use in my favor. By structuring a call debit spread, I’m harnessing that extra premium to unlock a higher profit potential. At current pricing, there’s a spread on the board with a projected 50.4% return—even if shares stay flat, climb higher, or even drop as much as 10% by expiration. That kind of setup greatly improves the odds of walking away with a win on this trade.

And if you want to learn more about how I find, structure, and trade opportunities like this—while getting multiple actionable trade setups each week—then joining my Options for Income Newsletter is a must. Right now, you can grab a trial month for only $1—that’s four full weeks of trade alerts and analysis for less than your favorite latte at the coffee shop. Don’t sit on the sidelines when you could be following along—go lock in your $1 trial today.

Wishing You the Best in Investing Success,

Blane Markham

Chief Trading Strategist

Author, Trade of the Day

Have any questions? Email us at support@markhamtrading.com

*Trading incurs risk and some people lose money trading.

Recent Comments