Exchange-traded funds (ETFs) are a great way to diversify at less cost.

They’re even better if they pay out dividends.

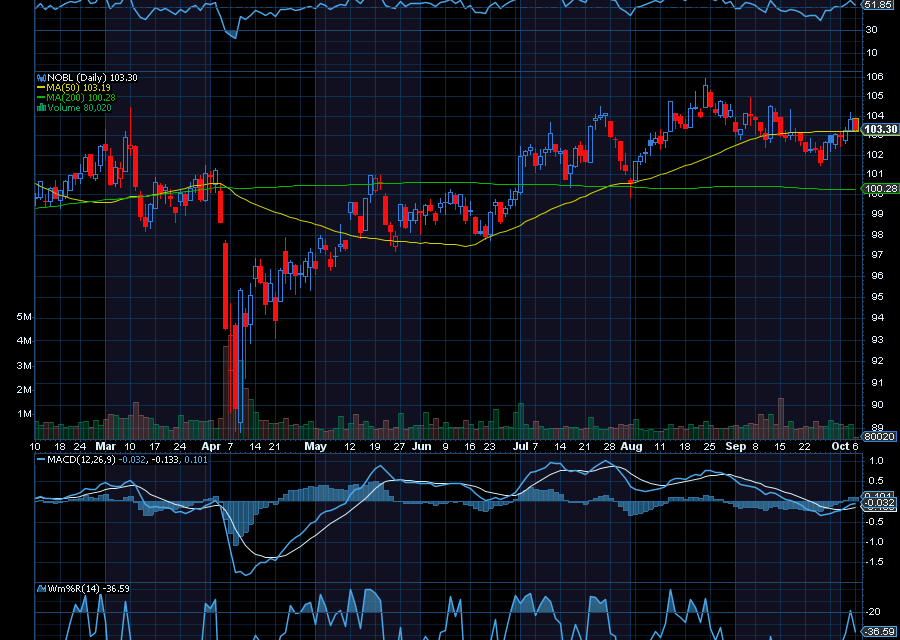

Look at the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), for example.

One of the best ways to generate reliable income is by investing in dividend aristocrats because they’re among the most reliable dividend payers.

Not only have these stocks paid out dividends for more than 25 years, they’re also some of the most reliable companies on the planet even in the worst of times. And while you could always buy a basket of aristocrats, you can instead pick up the NOBL ETF, which holds 66 of them and yields 2.46%. Its expense ratio is 0.35%.

Making it even more attractive, it’s been trending higher (with the exception of the 2020 drop along with a massive market pullback) since 2013.

Sincerely,

Ian Cooper

Recent Comments