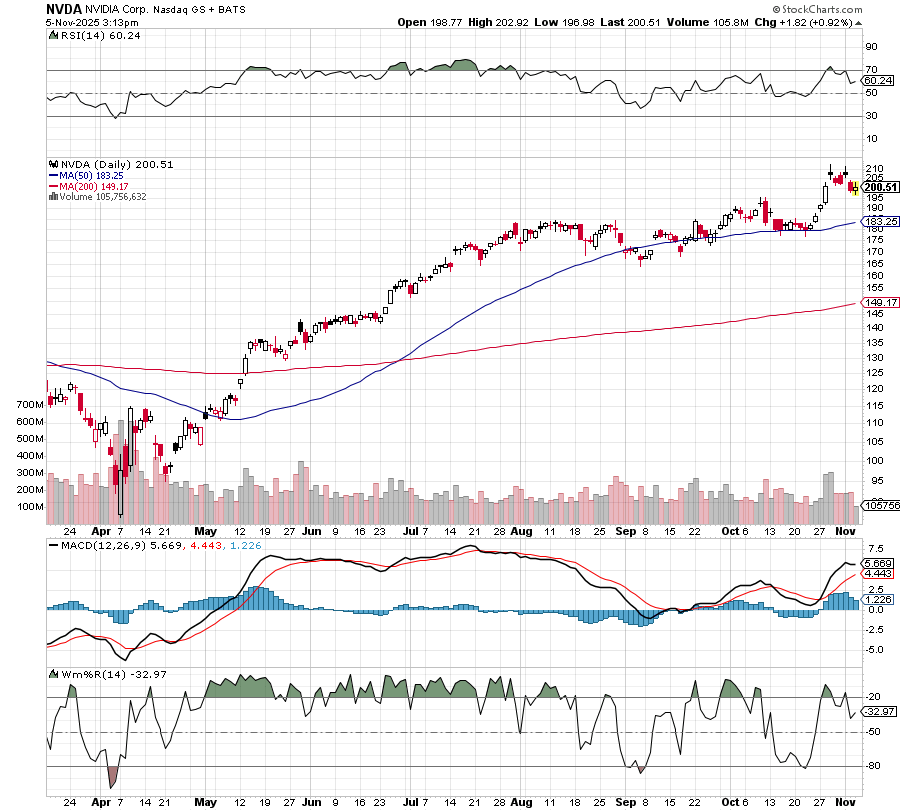

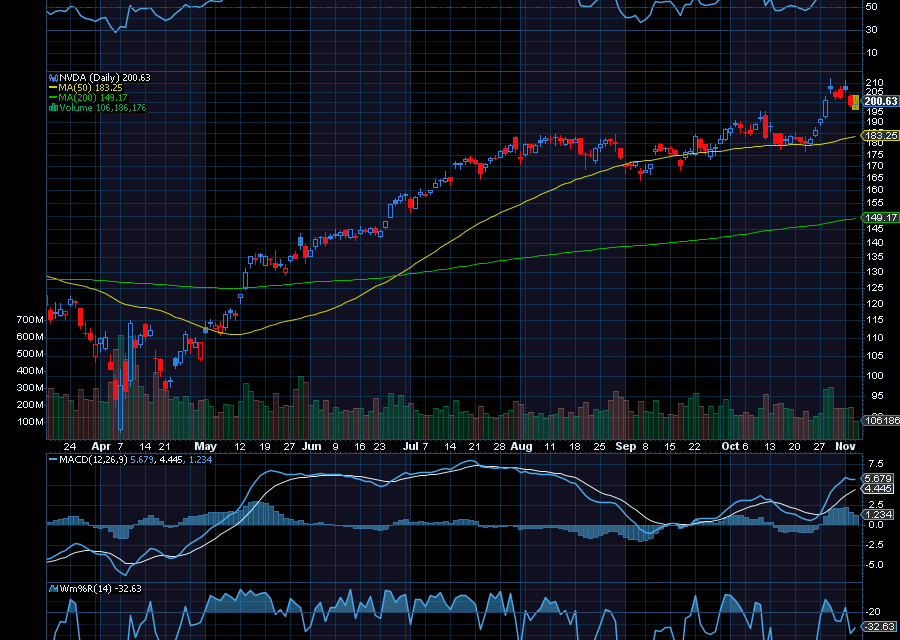

Nvidia (NVDA) is still gaining momentum ahead of earnings.

Helping, analysts at Melius just reiterated a buy rating on the tech giant. Rosenblatt Securities also raised its price target on Nvidia to $240 from $215 and reiterated its Buy rating.

In addition, Loop Capital reiterated its buy rating on the tech giant and hiked its price target to $350 from $250. The firm believes NVDA can double its GPU shipments over the next year to 15 months to 2.1 million by the January 2026 quarter.

Goldman Sachs reiterated its buy rating on NVDA with a price target of $240 from $210 ahead of earnings, as well. The firm believes investor expectations have risen heading into NVDA’s earnings, driven by multiple AI infrastructure announcements. The firm also believes NVDA will provide a beat and raise quarter. Helping, Nvidia is up on news that Microsoft secured export licenses from the Trump Administration to ship NVDA chips to the United Arab Emirates.

Fueling more momentum, NVDA recently held an event that included a wide-range of announcements, including CEO Jensen Huang’s statement that that the tech giant has “visibility” into $500 billion in sales for its Grace Blackwell and Vera Rubin lines of GPUs through 2026. He also outlined the growing role of NVDA GPUs in artificial intelligence models, telecommunications, quantum computing, enterprise, healthcare, science, energy, consumer goods, robotaxis and manufacturing.

In short, he’s reminding us that NVDA is everywhere and is still growing, explosively.

Sincerely,

Ian Cooper

Recent Comments