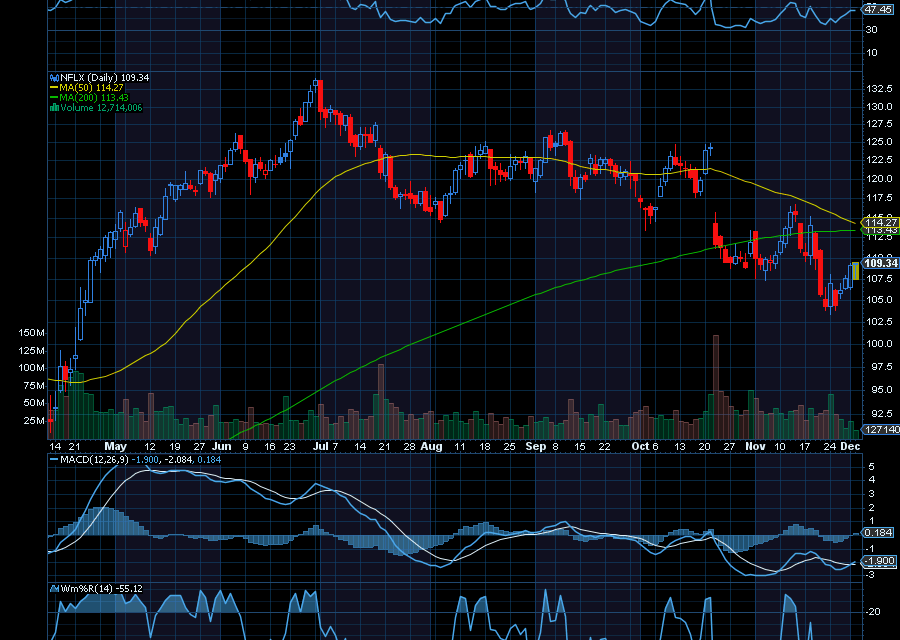

Not only ago, NFLX split 10 for 1. Following that split, NFLX pulled back to about to about $102.50, where it appears to have caught strong support, and is just starting to pivot higher. It’s also starting to pivot from over-extensions on RSI, MACD, and Williams’ %R. From its current price of $109.13, we’d like to see it test $115 shortly.

Helping, analysts at Seaport Global recently upgraded NFLX to a buy.

The firm highlighted “Netflix’s continued year-over-year market share gains against linear television, while noting that YouTube TV has maintained its position as the overall share winner in the streaming space,” as noted by Investing.com.

Earnings haven’t been too shabby either.

In its most recent quarter, NFLX revenue jumped 17% year over year. Profitability has also been strong, with an operating margin of 28%. While that’s down from 34% in the last quarter, that happened because of a Brazilian tax charge that management views as a one-time item. Moving forward, Netflix is calling for a full-year operating margin of 28%, up from 27% year over year.

With that, we’d use recent weakness in NFLX as an opportunity.

Sincerely,

Ian Cooper

Recent Comments