If insiders are putting their money where their mouths are, pay close attention.

After all, it’s the insiders who know their company the best. And if they’re willing to put down a good deal of money on it, it’s a clear sign they’re bullish on the future.

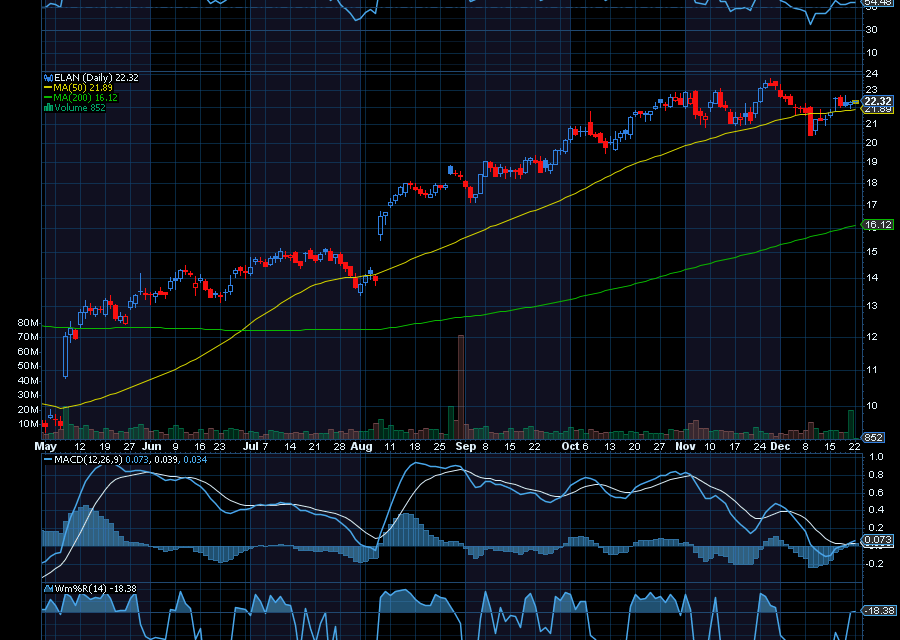

Look at Elanco Animal Health (ELAN).

Since bottoming out in April at around $8 a share, ELAN is now up to $22.30 and could rally even higher. Most recently, CEO Jeffrey Simmons paid $478,500 to buy 22,000 shares on December 11 at an average price of $21.75 a share. The company, which was spun off from Eli Lilly in 2018, has experienced explosive growth thanks to key product launches, including a chewable parasite preventative for dogs, as well as an anti-itch medication.

Americans spend big money on their pets. In 2024, the average household spent about $40 billion on vet care and pet medications alone.

By 2027, spending is expected to soar to $173 billion, as noted by Fortune. Americans will spend a total of $157 billion on their pets by the end of 2025; according to projections, U.S. pet spending will total almost $200 billion in 2030, as noted by Capital One Spending. Those are substantial catalysts for pet companies like ELAN.

Sincerely,

Ian Cooper

Recent Comments