We’ve been pounding the table for months to buy gold.

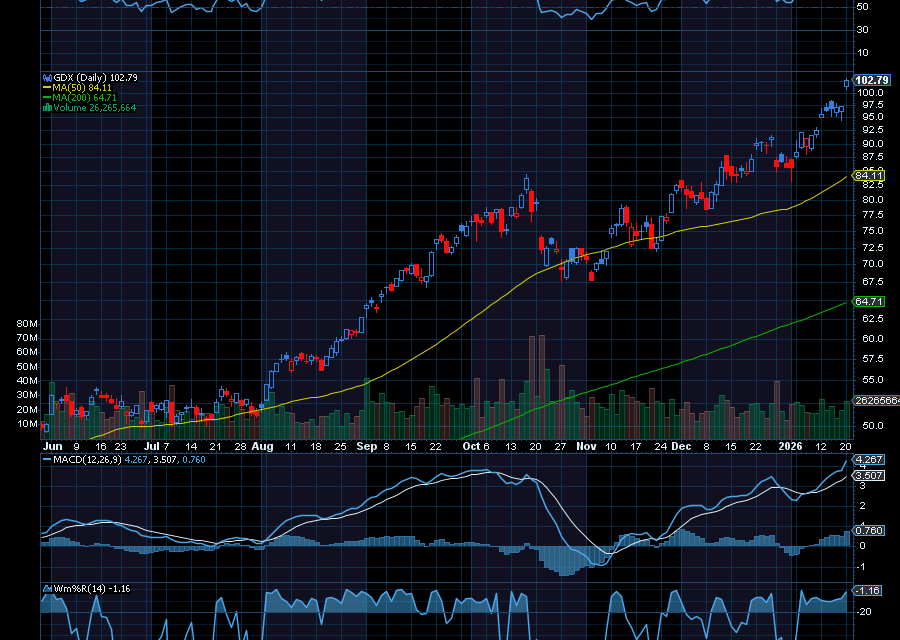

All thanks to geopolitical issues, inflation, interest rate cuts, economic disarray, and central bank buying. In fact, since late August, we’ve been pounding the table over ETFs such as the VanEck Vectors Gold Miners ETF (GDX), which ran from $60 to $102.31 so far.

The best part – it could run even higher, especially as gold gets closer to our $5,000 target.

There are even calls for $10,000 gold.

Central banks are buying at a record pace. Analyst calls for $5,000, even $6,000 gold, or higher, no longer seems far-fetched. Ed Yardeni of Yardeni Research says there’s a strong possibility we could see $10,000 gold over the next four years, thanks to massive government deficits, geopolitical stress, and inflationary issues.

And now, there’s new uncertainty as investors react to President Trump’s threat to impose tariffs on eight European countries opposed to the proposed U.S. takeover of Greenland.

In fact, according to the BBC, “Trump announced a 10% tariff on goods from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands and Finland would come into force on 1 February, but could later rise to 25% – and would last until a deal on Greenland was reached.”

Other factors for gold’s rise include expectations of more interest rate cuts, central banks adding hundreds of tonnes of gold to their reserves, and strong inflows into exchange-traded funds (ETFs).

For example, according to the World Gold Council, as gold prices shattered records about 53 times in 2025, annual inflows into physically backed gold ETFs rocketed to $89 billion, “the largest on record as the gold price delivered its strongest performance since 1979. In turn, global gold ETFs’ assets under management (AUM) doubled to an all-time high of US$559 billion, with holdings reaching a historic peak of 4,025t, up from 3,224t in 2024.”

Sincerely,

Ian Cooper

Recent Comments