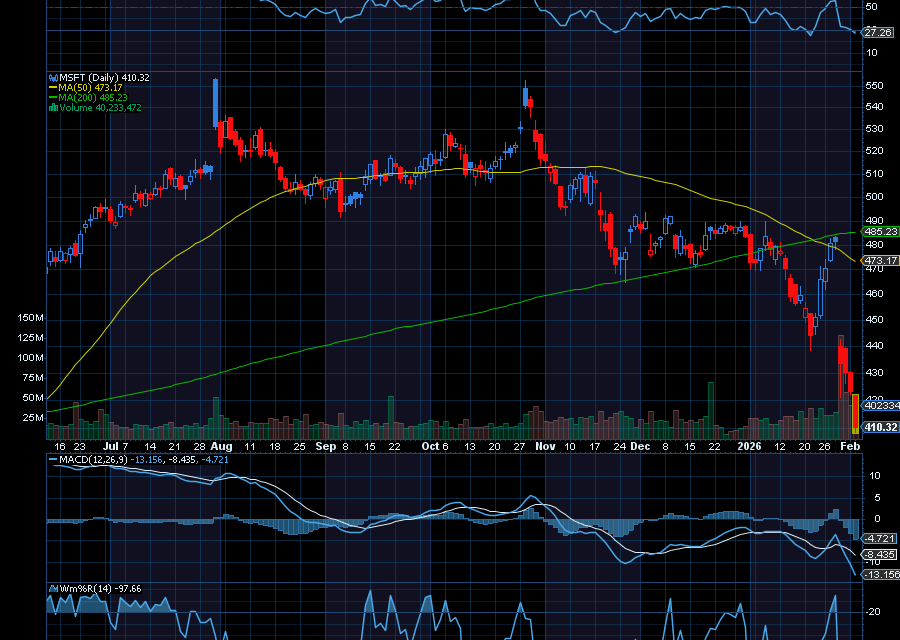

Once Microsoft’s falling knife catches support, investors may want to use weakness as an opportunity. For one, analysts at Piper Sandler named Microsoft its top pick in software.

Even with concerns about growth in Azure and other cloud offerings, the analysts believe investors are overreacting to the news. They also believe MSFT is a big winner with AI.

“We see Microsoft as perhaps the best pure-play on AI adoption today,” wrote analyst Billy Fitzsimmons, as quoted by CNBC. “We believe Microsoft is best positioned to benefit from the elevated AI infrastructure spending. We also believe Microsoft is in a better financial position than some peers to make the necessary capital expenditures, with a robust balance sheet and expectations that free cash flow remains soundly positive over the next few years.”

Helping, Deutsche Bank reiterated a buy rating on MSFT with a $575 price target. The firm noted that MSFT “reported another solid result for F2Q, but it ultimately fell short of more lofty market expectations, in particular for Azure growth,” as quoted by CNBC.

Analysts at Citi also have a buy rating with a price target of $660. RBC Capital analysts also have a buy rating with a $640 price target.

From its current price of $413.40, we’d like to see it rally back to $475 initially.

Sincerely,

Ian Cooper

Recent Comments