With speculation of a potential conflict with Iran, oil prices are up another $1.31 to $66.50.

We have to consider that Iran is one of the world’s leading suppliers, with its government making it clear that it will retaliate if the U.S. attacks. This could eventually lead to a full blockage of the Strait of Hormuz or restricted access.

All of which could send oil prices gushing even higher in the near term.

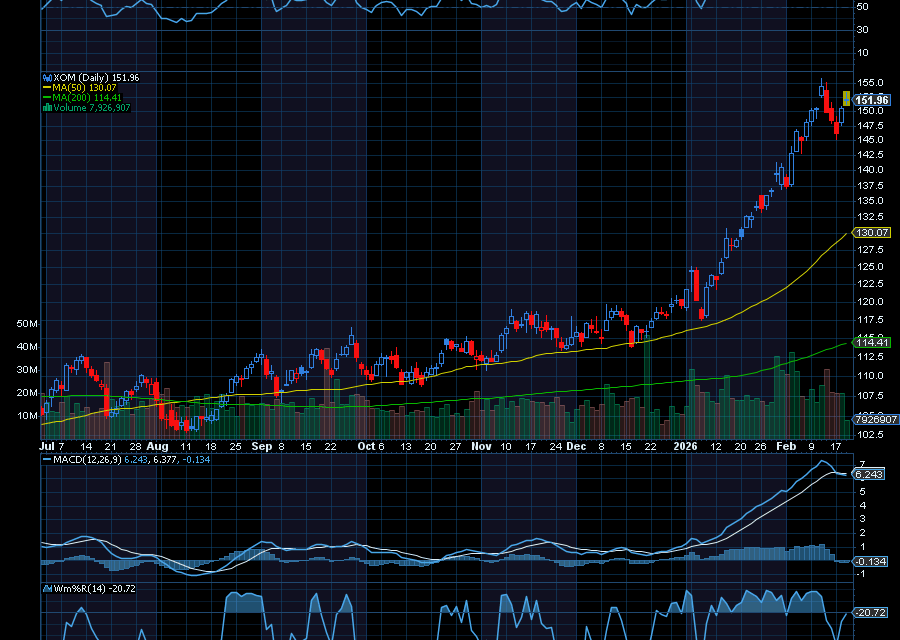

“Top national security officials have told Mr. Trump the U.S. military is ready for potential strikes on Iran as soon as Saturday, but the timeline for any action is likely to extend beyond this weekend, sources familiar with the discussions told CBS News, adding that President Trump had not yet made a final decision about whether to strike Iran.”Not only are oil stocks, such as Exxon Mobil (XOM) and Chevron (CVX), gushing higher on speculation of war, but so are related ETFs such as the Energy Select Sector SPDR ETF (XLE).

Sincerely,

Ian Cooper

Recent Comments