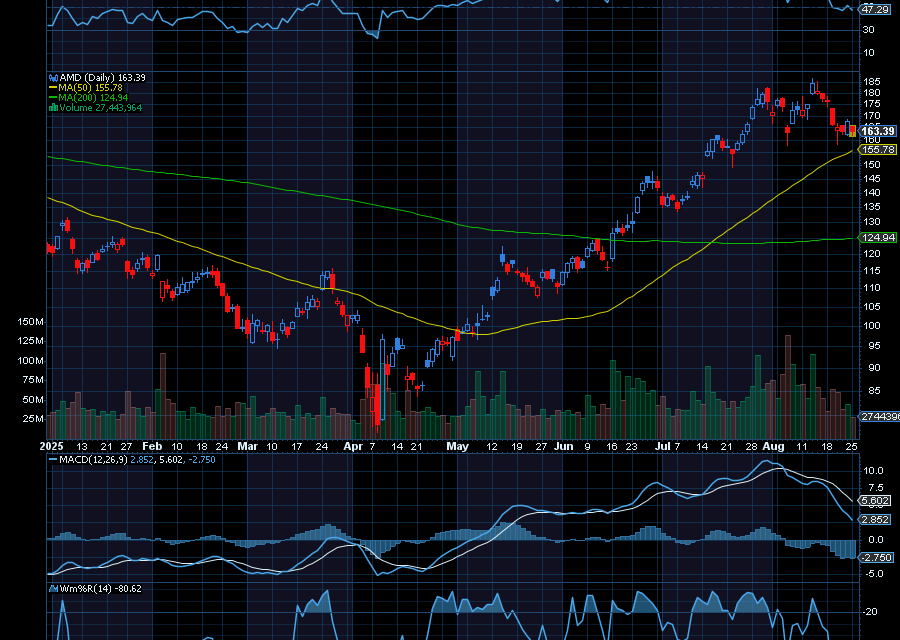

We have another opportunity to jump on Advanced Micro Devices’ (AMD) weakness.

After a brief pullback, AMD caught triple bottom support, and is just starting to pivot higher again. Last trading at $167.76, we’d like to see it initially retest $185 a share.

Longer term, we’d like to see it test $200.

Helping, analysts at Mizuho just raised their price target on AMD to $205 from $183.

As noted by Investing.com, “The firm specifically revised its Instinct GPU revenue projections upward across fiscal years 2025 through 2027, reflecting stronger anticipated demand for AMD’s AI accelerators. Mizuho’s analysis indicates AMD will benefit from the ramp of MI308 chips in China, while the MI355 product provides opportunity for additional upside, with Microsoft expected to increase capital expenditure significantly in fiscal 2026.”Analysts at Bank of America reiterated a buy rating on the stock with a $200 price target. The firm cited AMD’s market share gains as the expense of Intel as its catalyst.

Sincerely,

Ian Cooper

Recent Comments