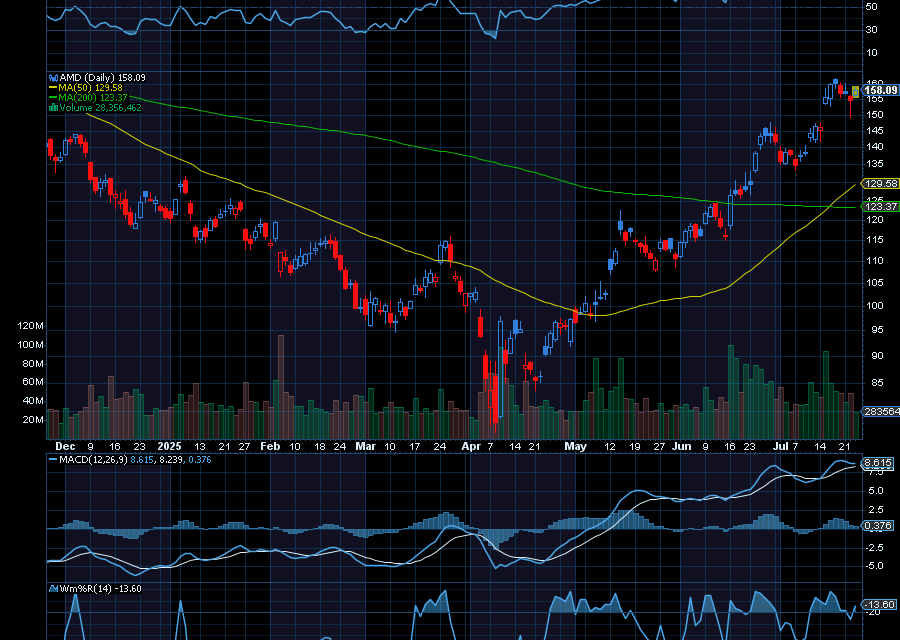

After a brief pullback, shares of Advanced Micro Devices (AMD) are just starting to pivot higher again. Last trading at $157.10, we’d like to see the stock test $175, near-term.

Helping, AMD Executive Vice President and Chief Commercial Officer, Philip Guido bought 8,800 shares of the stock for just under $1 million.

Two, we have to remember the company is exposed to a multi-billion-dollar addressable market for data center AI chips. In fact, according to company Chair and CEO Lisa Su, that addressable market for AI chips will reach $500 billion by 2028, which is up from her prior estimate for $400 billion by the time 2027 rolls around.

“This is roughly equivalent to the annual sales for the entire semiconductor industry in 2023. Su is optimistic about the long-term market size potential for AI chips, and believes that AI demand has exceeded the company’s expectations over the past year,” as noted by Barron’s.

And three, the company’s latest generation of AI chips, the MI300, is its fastest ramping product ever. Lisa Su added that AMD’s MI300X chip—which rivals dominant AI chipmaker Nvidia’s H100 is “the most advanced AI accelerator in the industry,” as noted by Time.com.

Sincerely,

Ian Cooper

Recent Comments