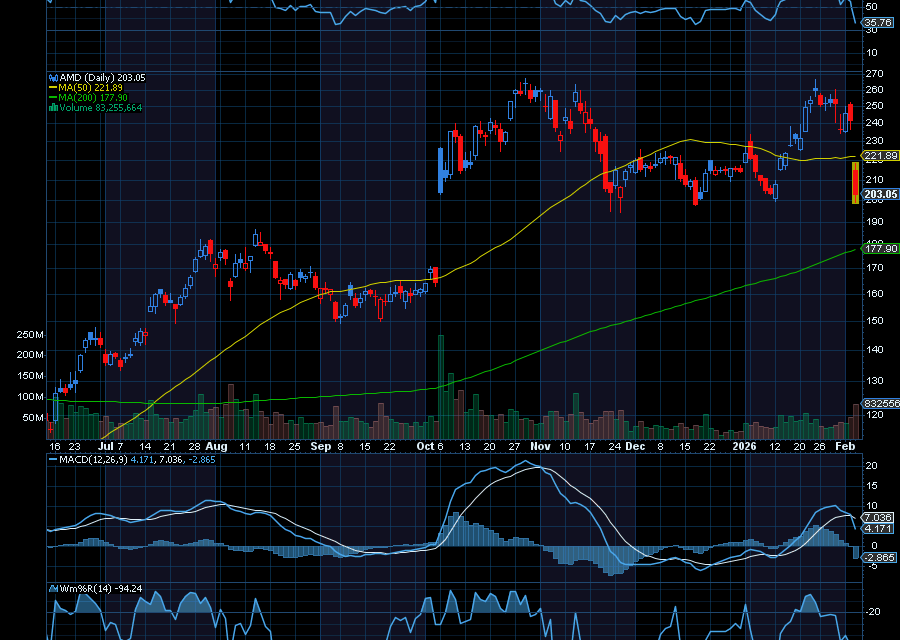

Advanced Micro Devices plummeted on guidance.

However, the dip may be a buy opportunity.

In the fourth quarter, AMD posted revenue of $10.27 billion, which was above estimates of $9.67 billion. Data Center revenue was up 39% year-over-year to $5.4 billion thanks to its MI300 AI accelerator and its Instinct and EPYC processors. Analysts were anticipating $4.97 billion in Data Center revenue.

Moving forward, AMD said it expects first-quarter sales to be between $9.5 billion and $10.1 billion, with the mid-point of $9.8 billion, which is above the $9.39 billion estimate. Still, that wasn’t good enough for analysts who were hoping for stronger revenue guidance, especially with the ongoing boom in spending for AI.

In short, the mid-point, which is 32% year over year growth and higher than estimates, wasn’t good enough. Helping, analysts at Barclays reiterated an overweight rating on AMD, noting that the company is gaining share in PC and Server with a “a call option on AI with significant potential spend from OAI [Open AI] and other customers,” as quoted by CNBC.

Pay close attention to AMD. Weakness here may be an opportunity soon.

Sincerely,

Ian Cooper

Recent Comments