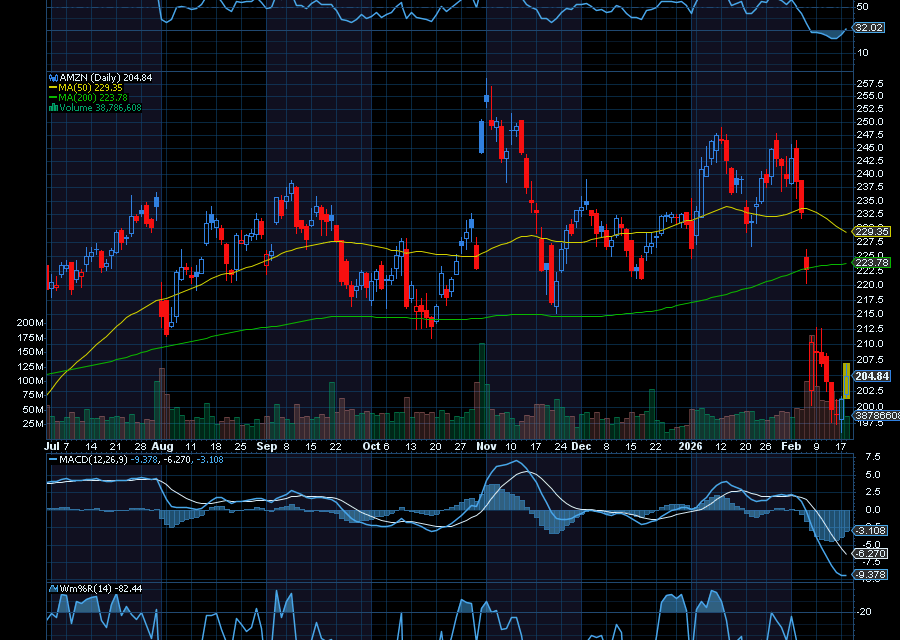

After a rough few weeks, shares of AMZN appear to have finally bottomed out and are just starting to pivot higher. It’s also oversold on RSI, MACD, Williams’ %R, and on Full Stochastics.

Helping, analysts at Morgan Stanley just reiterated their overweight rating on the stock.

The firm said, “AMZN is a top pick as AWS/Retail, both under-appreciated GenAI winners. AWS seems set to further accelerate as capex yield framework shows how it could grow 30%+ in ’26/’27. We also discuss why AMZN is an agentic winner with leverage and why partnerships would be positive/ manageable,” as quoted by CNBC.

Last trading at $205, we’d like to see it initially refill its bearish gap at around $220. After that, we’d like to see it refill its bearish gap at around $235.

Sincerely,

Ian Cooper

Recent Comments