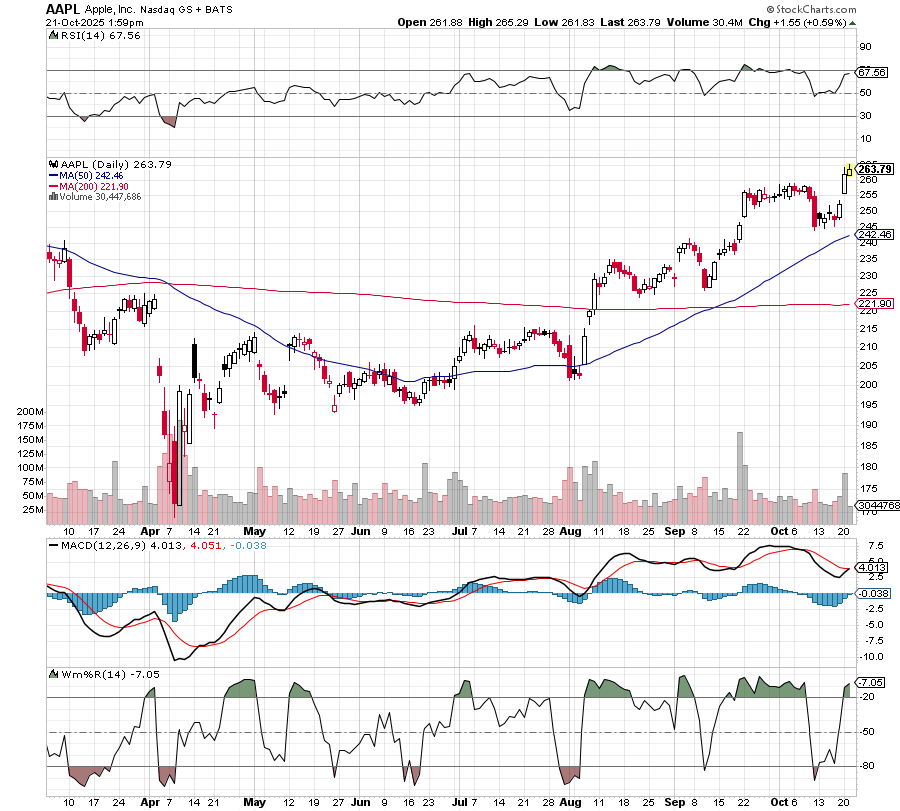

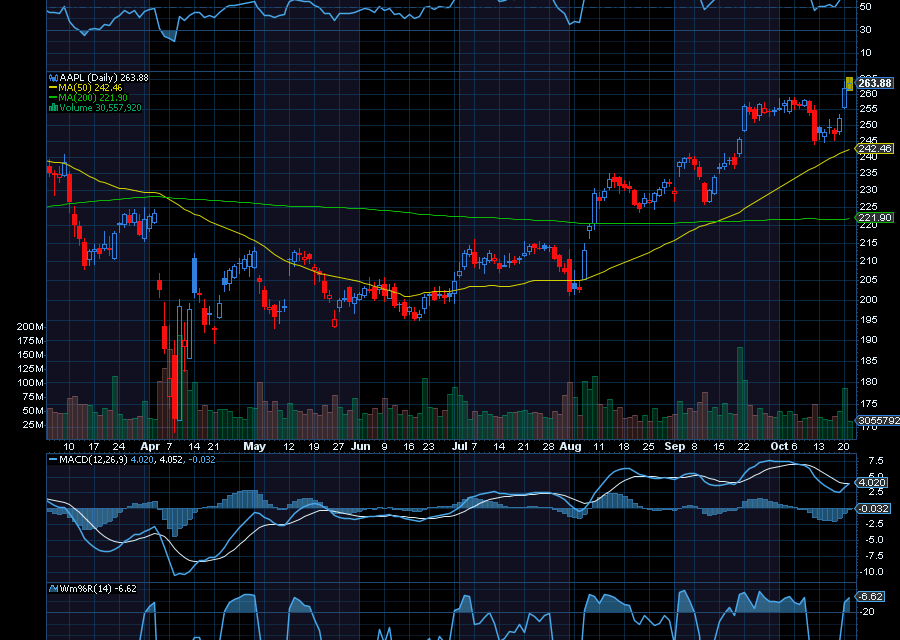

“Apple is again a buy opportunity.”

“After pulling back from about $259 a share, Apple found support at $245, where it’s been consolidating. From its last traded price of $252.29, we’d like to see the tech giant rally back to $259 initially. Helping, new iPhone 17 sales are outpacing iPhone 16 sales by 14% during the first 10 days on availability in the U.S. and China,” we added.

Today, Apple is up to $263 a share and could push even higher.

In addition to strong iPhone 17 sales, an upgrade helped push Apple even higher. Analysts at Loop Capital upgraded the tech giant to a buy rating with a price target of $315 a share on expectations Apple could set record shipments.

In fact, “Loop’s Ananda Baruah estimates Apple could ship 238 million iPhones this year, just short of 2021’s 240 million record, and followed by shipping 250 million units in 2026 and 260 million in 2027,” as noted by Barron’s.

Last trading at $263, we’d like to see Apple initially rally to $270 a share.

Sincerely,

Ian Cooper

Recent Comments