Bitcoin now trades at less than $70,000 and could test $60,000 at this pace.

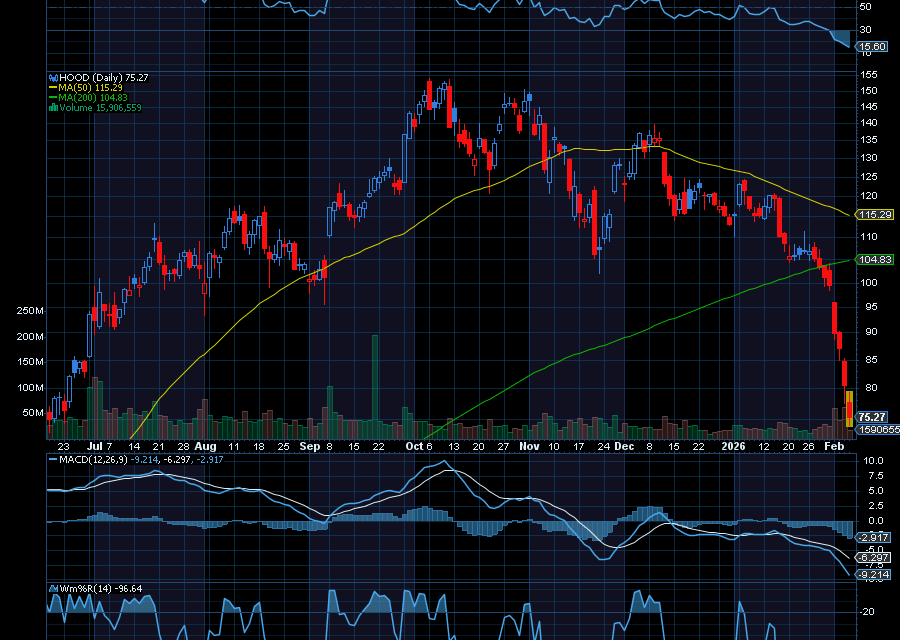

In fact, it last traded at $69,261.42 – which is great news for traders that are short related stocks, such as Robinhood (HOOD) and Strategy (MSTR), which just saw its price target by analysts at Canaccord.

Both have become falling knives and could drop even more.

Until Bitcoin shows some signs of bottoming out – which may not happen any time soon – both of those stocks are solid short opportunities.

More bearish forecasts see Bitcoin falling below $60,000, with extreme downside scenarios pointing to levels near $30,000.

Several analysts cite weakening technicals and a fragile market. Crypto commentator Crypto Bitlord recently flagged $30,000 as a key long-term support level. He argues that the latest decline—triggered by a broader global market selloff—has further to run.

Plus, profit-taking has coincided with thinning liquidity and a lack of incremental buyers, according to CoinDesk. CoinDesk added that demand has faded, leaving prices more vulnerable to forced selling and derivatives-driven liquidations.

Sincerely,

Ian Cooper

Recent Comments