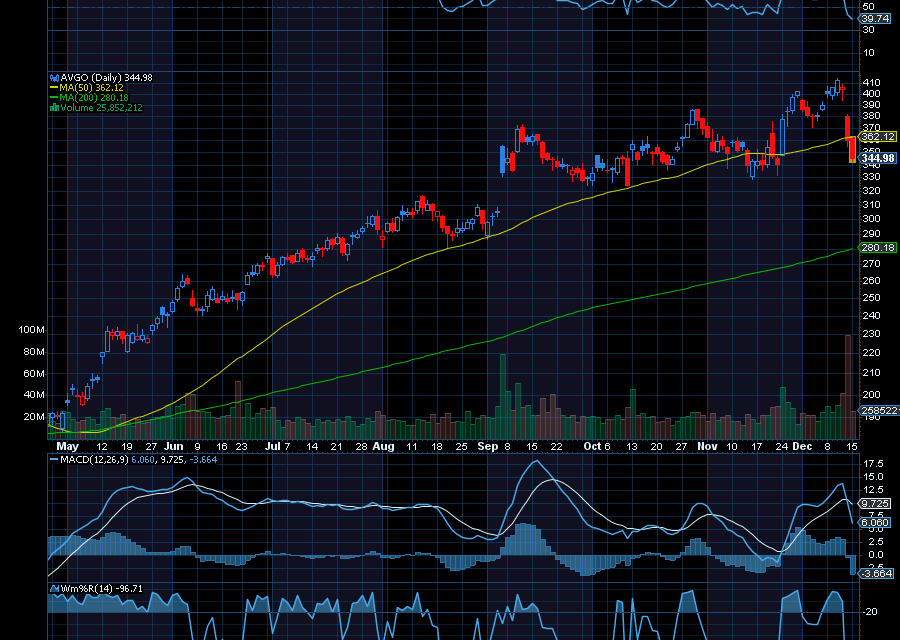

Broadcom took a massive hit late last week, falling $46.44 on Friday.

All after management warned of margin pressures.

Broadcom posted strong earnings and gave a strong forecast. Unfortunately, the stock fell “after the chipmaker warned growing sales of lower-margin custom AI processors were squeezing profitability, sparking worries that the business may be less lucrative,” as noted by Reuters. “The warning on margin impact deepened investor jitters over Big Tech’s AI returns, a day after Oracle fell 10.8%.”

However, the pullback is now being seen as an overreaction.

Helping, analysts at Morgan Stanley still expect for AVGO to see strong growth moving forward.

With an overweight rating on AVGO, Morgan Stanley has a $462 price target on AVGO. They also believe the latest pullback is an overreaction.

Analysts at Bank of America have a $500 price target with a buy rating. Goldman Sachs has a $450 price target with a buy rating. UBS has a $472 price target with a buy rating. And Bernstein has a $475 price target with an outperform rating.

Sincerely,

Ian Cooper

Recent Comments