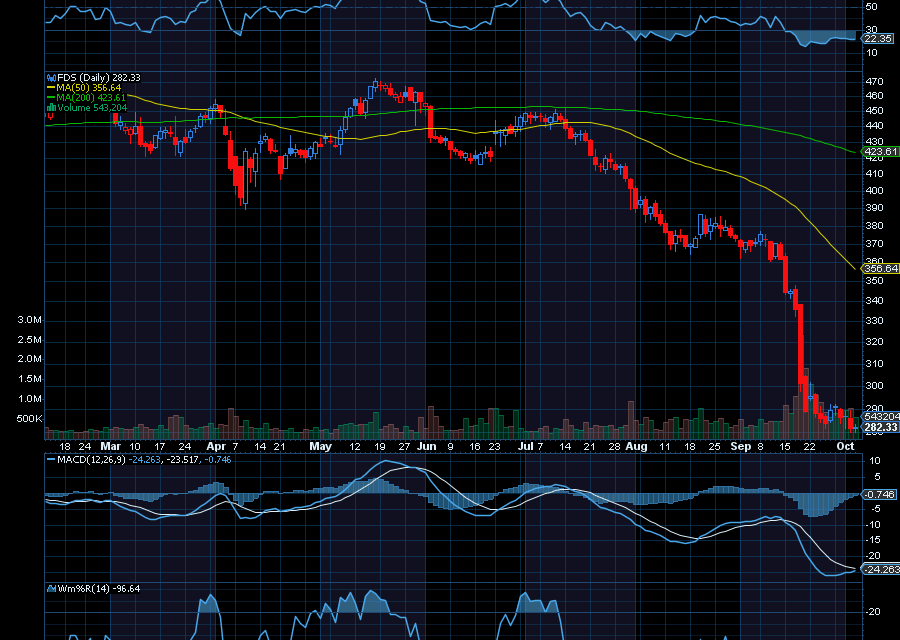

FactSet Research Systems (FDS) was the worst performing stock on the S&P 500 for the third quarter. In fact, thanks to lower than expected earnings, and a poor forecast, the stock plummeted from a high of about $452 to a recent low of $282.33.

At its current price, the stock is now severely oversold on RSI, MACD, and Williams’ %R. Making it even more attractive, the company’s Chief Legal Officer Christopher McLoughlin just bought 334.62 shares for about $100,000.

As noted by Barron’s, “McLoughlin bought 334.62 shares at an average price of $296.18 each, then purchased an additional three shares for $297.66 apiece. The transactions brought the number of shares owned directly to 3,445.62, which were valued at around $973,180 as of Friday’s close.”

Helping, analysts at UBS just upgraded the stock to a buy rating, with a price target of $425.s

“We believe FDS (and the info services sector as a whole) has gotten caught up in a negative AI disruption theme, which has weighed on multiples,” as quoted by Seeking Alpha.

“While we certainly do not take potential AI-driven market changes lightly, we believe the market does not fully appreciate the stickiness of FDS’ solutions in a slow-moving industry. Moreover, FDS has actually shown that it can integrate AI quickly, while the company is also executing well on other new initiatives,” added the firm.

Sincerely,

Ian C

Recent Comments