The artificial intelligence boom is still accelerating.

With the global AI market already surpassing $230 billion in 2024, analysts now see a clear path to multi-trillion-dollar expansion – and the next five years may deliver the strongest gains yet.

Forecasts now place AI’s value between $1.7 and $3.5 trillion by the early 2030s, with the most aggressive estimates topping $7 trillion by 2035. And judging by the surge in corporate investment, the market is moving toward the high end of those projections.

In fact, some of the largest tech companies are sending a clear message that the AI boom is far from over. Just look at recent capex spending.

- Google raised its 2025 capex outlook to $91–$93B

- Microsoft is increasing spending 74% to $34.9B

- Meta nearly doubled capex to $19.37B, far above expectations

- Amazon projects $125B in 2025 capex, with more increases planned for 2026

For investors, these numbers are impossible to ignore. Even better, analysts at UBS now expects global AI capex to hit $571B in 2026, with a runway to $3 trillion by 2030.

So, how can we invest in the AI story, even after all of the momentum?

You can always jump into Nvidia, Advanced Micro Devices, Palantir, and Taiwan Semiconductor.

In fact, investing in all of them isn’t a bad idea at all.

But if you want good exposure, consider ETFs, such as:

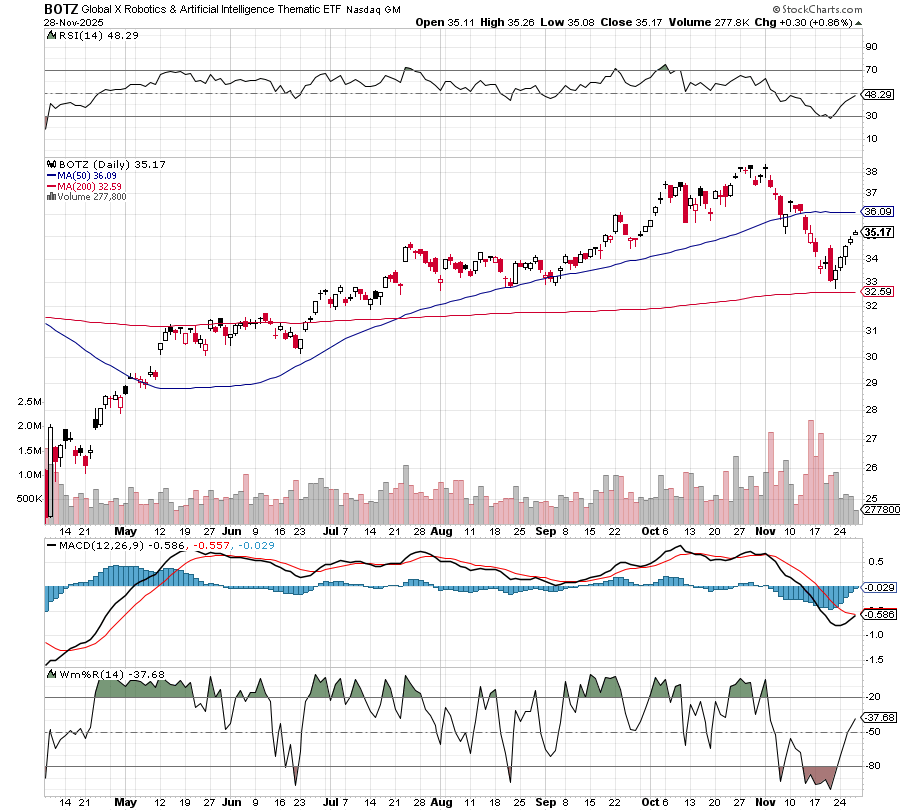

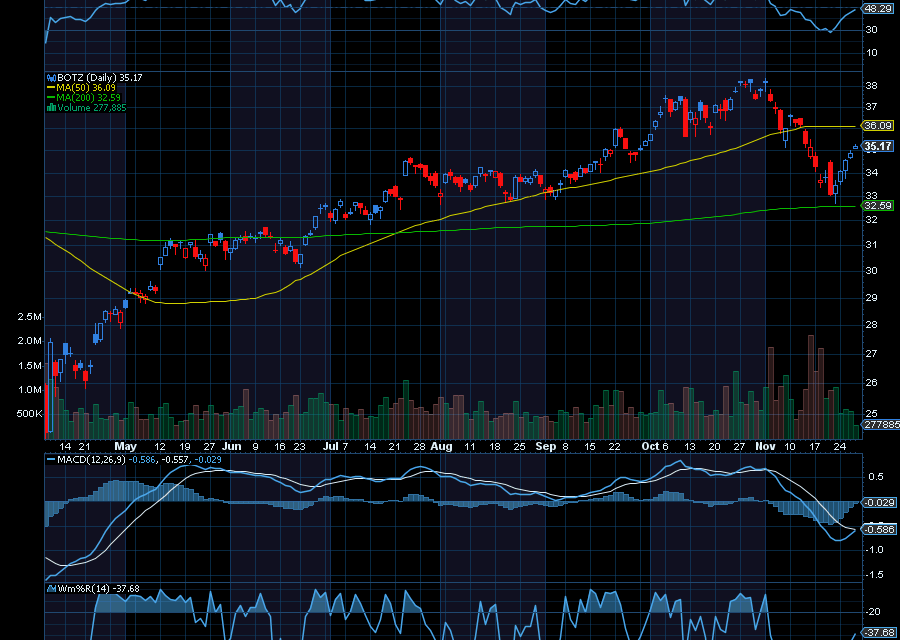

Global X Robotics and Artificial Intelligence ETF (BOTZ)

Another one of the top AI ETFs to consider is the Global X Robotics and Artificial Intelligence ETF. With an expense ratio of 0.68%, the ETF invests in companies that should benefit from the increased adoption of robotics and AI. Some of its 49 holdings include Nvidia, Keyence, DynaTrace, SMC Corp., Intuitive Surgical, and Upstart Holdings, and C3.ai, to name a few.

Sincerely,

Ian Cooper

Recent Comments