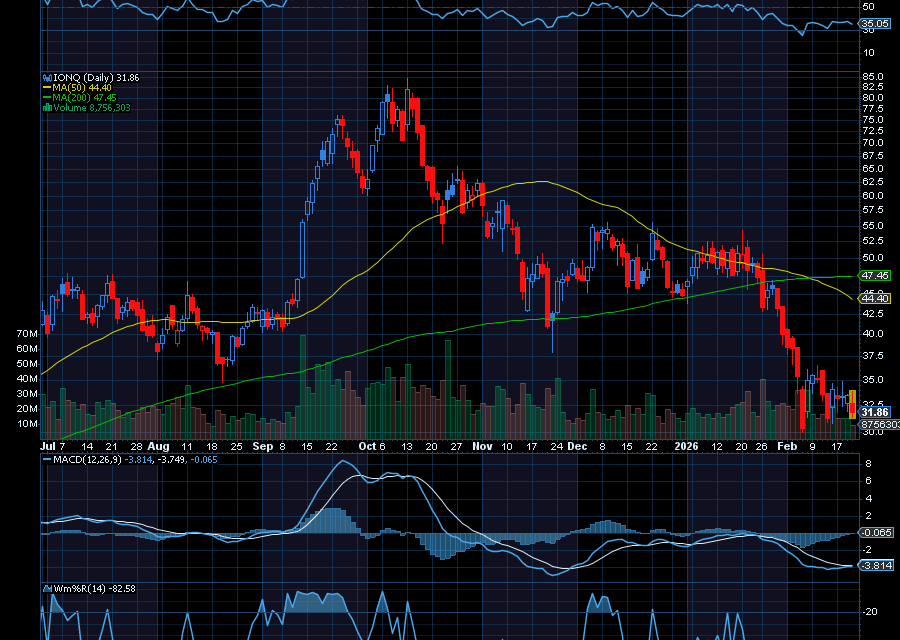

Weakness may be a buy opportunity in quantum computing company, IonQ.

For one, a good deal of fear has been priced into the stock.

Two, earnings are expected to remain strong next week.

For Q4 2025, analysts are looking for another quarter of solid revenue. Current estimates point to revenue of around $40 million for the quarter, reflecting further solid growth. EPS is expected to be negative with a loss of about 51 cents per share, which is an improvement. For full-year 2025, IONQ already guided revenue in a range $106 million to $110 million, with analysts expecting results near the high end of that range.

In its Q3 2025 earnings report, the company crushed estimates on the top and bottom lines. Its 17 cent-per share loss beat by three cents. Revenue of $39.87 million, up 221.5% year over year, beat by $12.88 million. Granted, it also posted a net loss of about $1.05 billion, but most of that was from large, non-cash charges and rising costs.

Three, IONQ could dominate a potential $198 billion market.

Moving forward, we do expect to see far better results from the company – especially as it attempts to dominate a potential $198 billion market by 2040. Fueling momentum, IONQ recently became the only quantum computing companies to demonstrate two-qubit gate fidelities of 99.99%. That means IONQ’s platform makes just one error out of every 10,000 tries, which gives it a massive lead over its competition.

As IONQ improves its technology to become even more accurate, it could dominate the quantum computing sector, which, according to McKinsey & Co. could be worth between $28 billion and $72 billion by 2035. By 2040, it could be worth $198 billion.

Sincerely,

Ian Cooper

Recent Comments