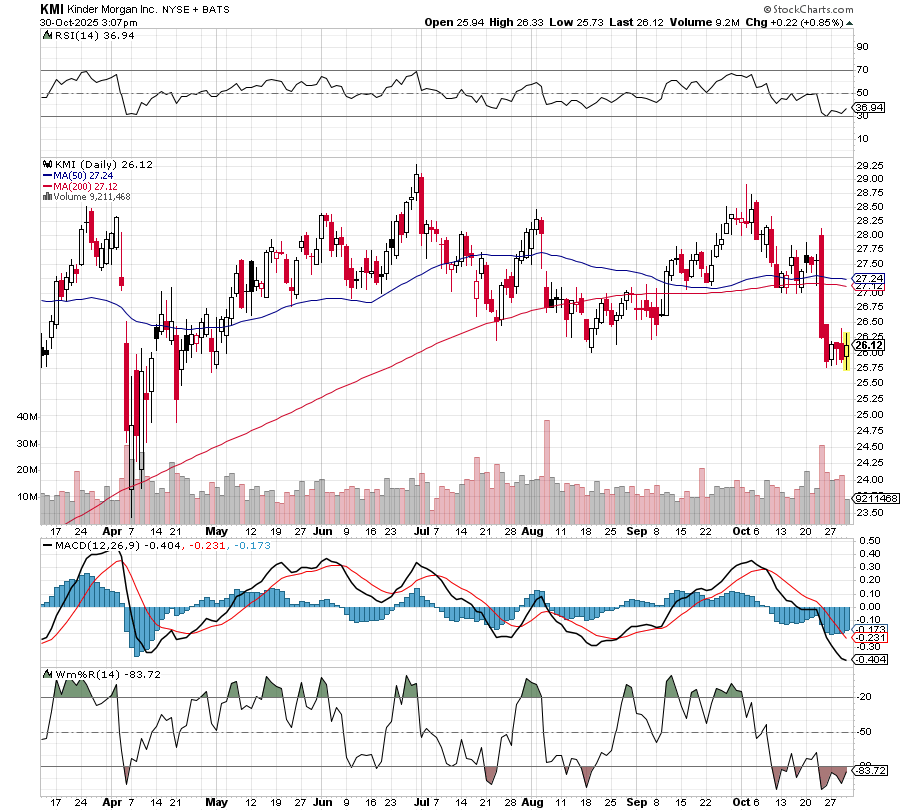

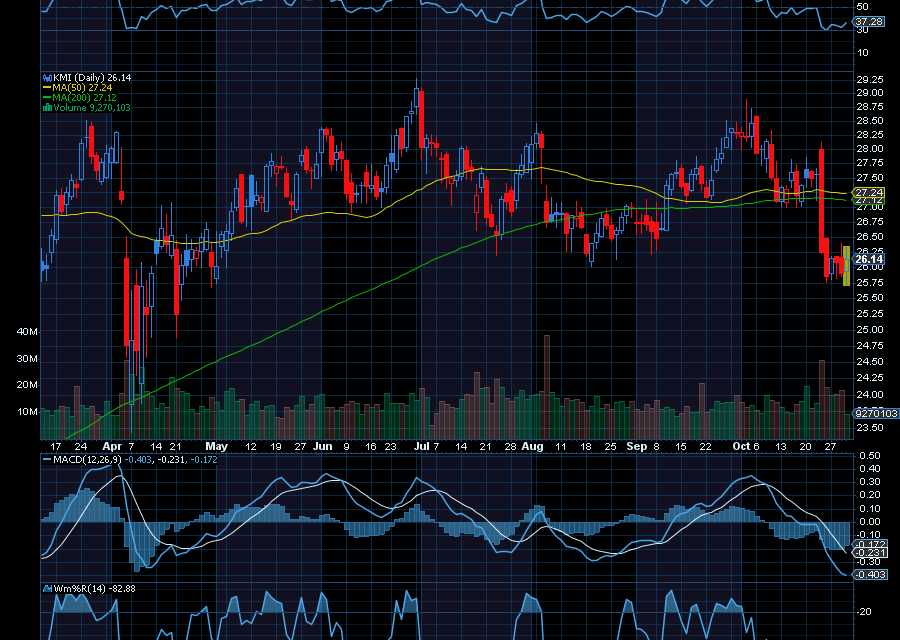

After dropping from about $28.91 to a low of $25.74, Kinder Morgan (KMI) appears to have caught strong support. Slowly pivoting higher, we’d like to see KMI retest $28.91 initially.

Fueling momentum, Executive Chairman Richard Kinder just bought a million shares of just under $26 million on October 27.

Helping, power demand is expected to explode over the next few years thanks to artificial intelligence and data centers. According to JLL.com, “Consumers and businesses are expected to generate twice as much data in the next five years as all the data created over the past 10 years.” All of which is good news for Kinder Morgan’s stock.

“Data center storage capacity is expected to grow from 10.1 zettabytes (ZB) in 2023 to 21.0 ZB in 2027, for a five-year compound annual growth rate of 18.5%,” they added.

“Not only will this increased storage generate a need for more data centers, but generative AI’s greater energy requirements – ranging from 300 to 500+ megawatts – will also require more energy efficient designs and locations. The need for more power will require data center operators to increase efficiency and work with local governments to find sustainable energy sources to support data center needs.”

Making it even more attractive, KMI yields 4.5%.

It announced a Q3 2025 cash dividend of $0.2925 per share, which is payable on November 17, 2025, to shareholders of record as of November 3, 2025.

Sincerely,

Ian Cooper

Recent Comments