Investors may want to use Microsoft’s (MSFT) weakness as an opportunity.

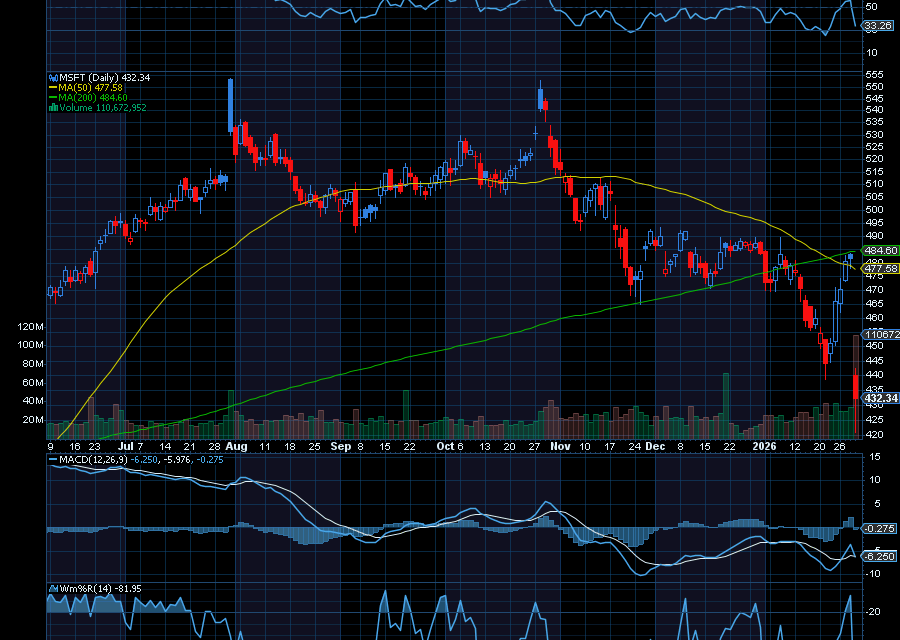

At the moment, the stock is down $53 a share after reporting that cloud growth slowed in the second quarter. It also issued soft guidance on operating margins.

The good news is that MSFT’s EPS of $4.14 was better than the estimates of $3.97.

Revenue of $81.27 billion was also higher than the estimates for $80.27 billion. With guidance, the company called for revenue of between $80.65 billion and $81.75 billion, with its mid-range of $81.2 billion meeting estimates of $81.19 billion.

Helping, Deutsche Bank reiterated a buy rating on MSFT with a $575 price target. The firm noted that MSFT “reported another solid result for F2Q, but it ultimately fell short of more lofty market expectations, in particular for Azure growth,” as quoted by CNBC.

Analysts at Citi also have a buy rating with a price target of $660. RBC Capital analysts also have a buy rating with a $640 price target.

Sincerely,

Ian Cooper

Recent Comments