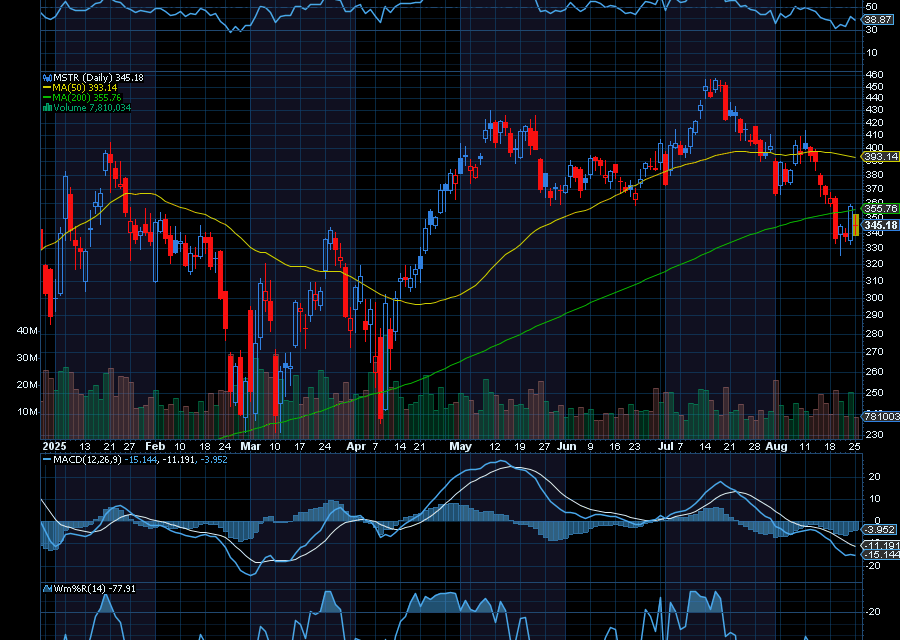

With Bitcoin oversold, keep an eye on oversold Bitcoin-related stocks like MicroStrategy (MSTR). Last trading at $358.13, MSTR is now oversold at support dating back to April. It’s also over-extended on RSI, MACD, and Williams’ %R. From here, we’d like to see MSTR retest $425.

The last few times MSTR became this technically oversold, it bounced as expected. In fact, we saw it bounce in April, in late February, and last September from similar oversold conditions. Fueling further upside potential, MSTR just bought another $51.4 million worth of Bitcoin during the week of August 11 to 17. MSTR now owns a total of 629,378 BTC.

Recent MSTR earnings have also been strong.

Q2 EPS of $32.60 beat estimates by $32.67. Revenue of $114.49 million, up 2.7% year over year, beat by $1.97 million.

Also, as noted by CFO Andrew Kang:

“Strategy has achieved a year-to-date BTC Yield of 25%, meeting our full year target well ahead of our initial timeline. As a result, our BTC $ Gain now exceeds $13 billion, and the increase in the price of bitcoin in the second quarter drove second quarter operating income of $14 billion and Q2 diluted EPS of $32.60.”

“These financial results, built upon the scale and performance of our bitcoin balance sheet, are at all-time highs for the company and rank among the most successful quarterly results across the largest public companies in the world. In addition, we are announcing FY2025 guidance for Operating Income of $34 billion, Net Income of $24 billion, and Diluted EPS of $80 per share, based on a BTC price outlook of $150,000 at the end of the year.”

Sincerely,

Ian Cooper

Recent Comments