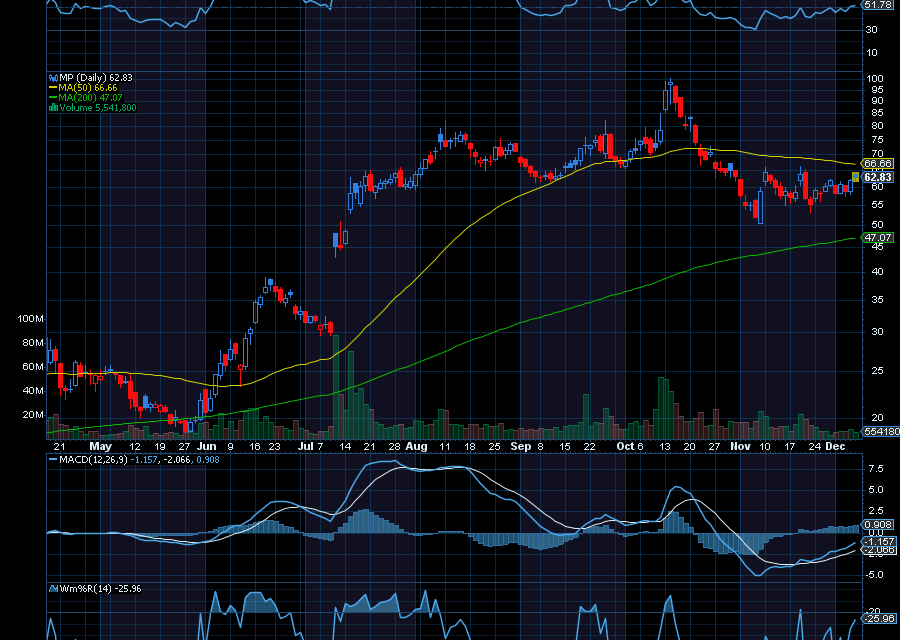

MP Materials (MP) is still a strong buy opportunity.

The last time we mentioned MP Materials, it traded at $56.94 on November 17. Today, it’s up to $63.08 and could rally even higher.

In fact, with the U.S. battle over rare earth, Morgan Stanley just upgraded MP Materials to an overweight rating with a price target of $71 a share. While China did pause its rare earth restrictions for a year, there is still a strong possibility of more rare earth supply issues, which MP Materials can assist with.

Not only ago, analysts at JPMorgan upgraded the miner to an overweight rating with a price target of $74 a share. “Our new rating reflects our view that rare earths national security concerns are ‘here to stay’ despite China’s reported one-year pause on export restrictions, with risks remaining, especially for military exposure,” they said, as quoted by CNBC.

“MP’s unique mine-to-magnet vertical integration positions the company as the ex-China leader ready to immediately begin addressing these concerns, although it will ultimately take multiple players over many years to sort out.”

Sincerely,

Ian Cooper

Recent Comments