Artificial intelligence is fueling massive upside in energy stocks, most recently nuclear energy.

Just last week, Meta unveiled agreements to secure about 6.6 GW of nuclear power by 2035 for its data centers. One of those deals was with Vistra Energy (SYM: VST), which will provide electricity from three existing nuclear power plants.

Meta is also partnering with Oklo (OKLO) with small modular reactors in Ohio for up to 1.2 gigawatts starting in 2030. Meta will also work with TerraPower, which will receive funding for two reactors delivering up to 690 megawatts by 2032.

But there’s another stock that could benefit from the power demand, too.

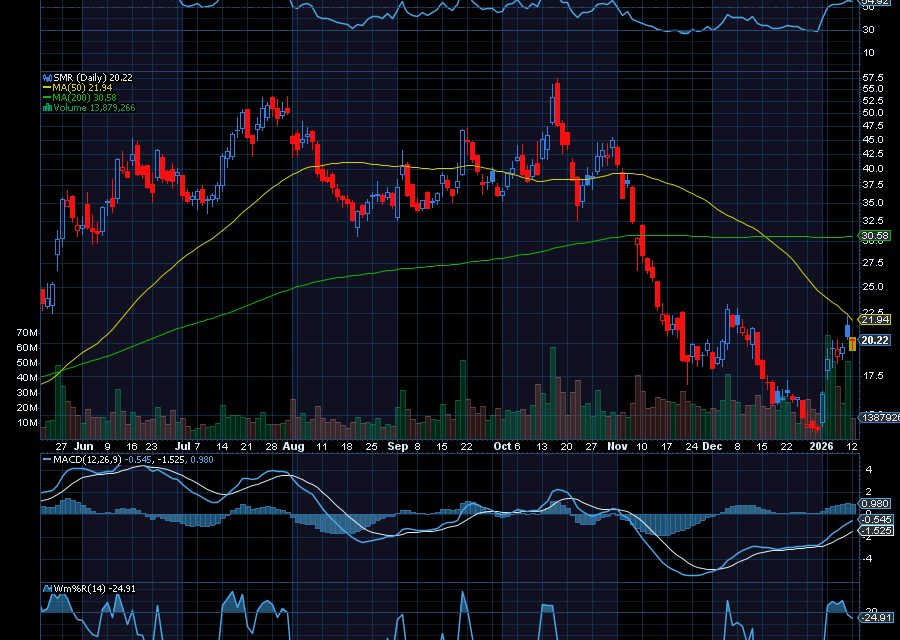

NuScale (SMR)

Over the last few years, NuScale received U.S. Nuclear Regulatory Commission (NRC) standard design approval for its 50-megawatt-electric module in 2023 and its uprated 77-megawatt-electric version in May 2025, making it the only company with such certifications for multiple module designs. These approvals allow for faster deployment compared to traditional reactors, appealing to larger companies seeking quick, reliable energy builds.

Helping, analysts at Bank of America just upgraded the SMR stock with a $28 price target.

“The upgrade comes after the small modular reactor technology company experienced a substantial correction from its previous highs, with BofA upgrading the stock from Underperform to Neutral while adjusting its price target to $28 from the previous $34, still implying a potential 42% upside from current levels,” as noted by Tokenist.com.

Last trading at $20.75, we’d like to see SMR rally back to $35 initially.

Sincerely,

Ian Cooper

Recent Comments