Cantor Fitzgerald just raised its price target on Nvidia (NASDAQ: NVDA) by $60 to $300 a share, with an overweight rating. The firm believes that artificial intelligence is still in the early innings and could be a substantial driver of Nvidia’s growth moving forward.

“Cantor Fitzgerald emphasized that the AI market is “not a bubble,” describing it as the “early innings of a multi-trillion AI Infrastructure build-out” with hyperscalers alone providing visibility into hundreds of billions in demand over the next few years,” as noted by Investing.com.

As noted by Seeking Alpha, “The next highest target was set by Melius Research, which increased its target to $275 from $240 earlier this week. Goldman Sachs recently increased its price target to $210 from $200. Last month, Bank of America increased its target to $235 from $220, and Barclays boosted its target to $240 from $200. In August, Wells Fargo hiked its target to $220 from $185.”

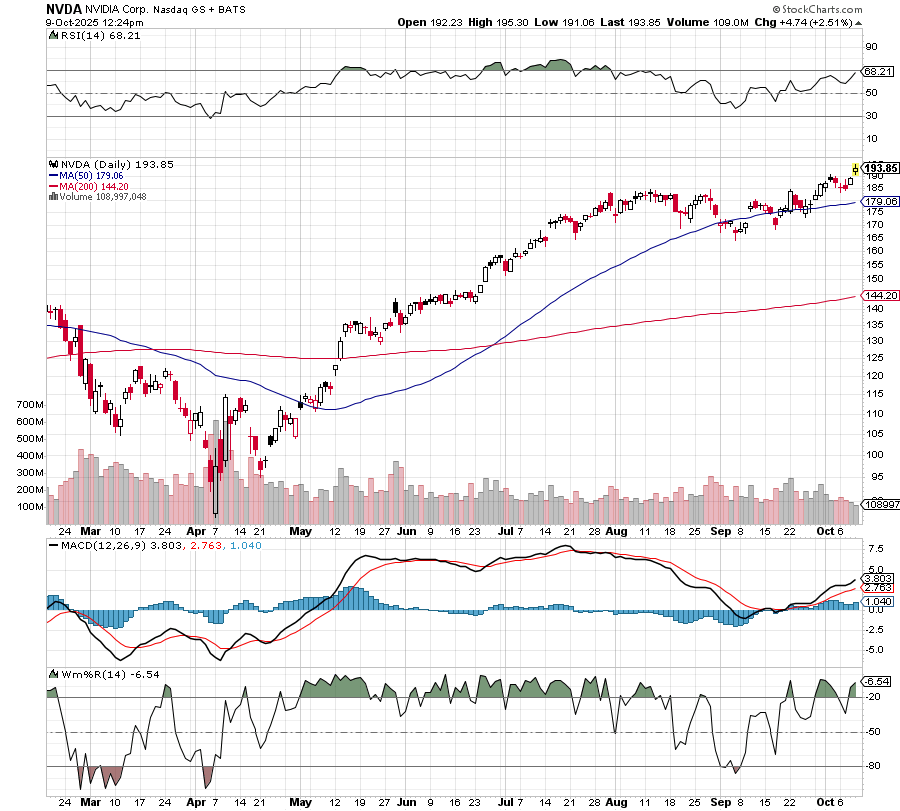

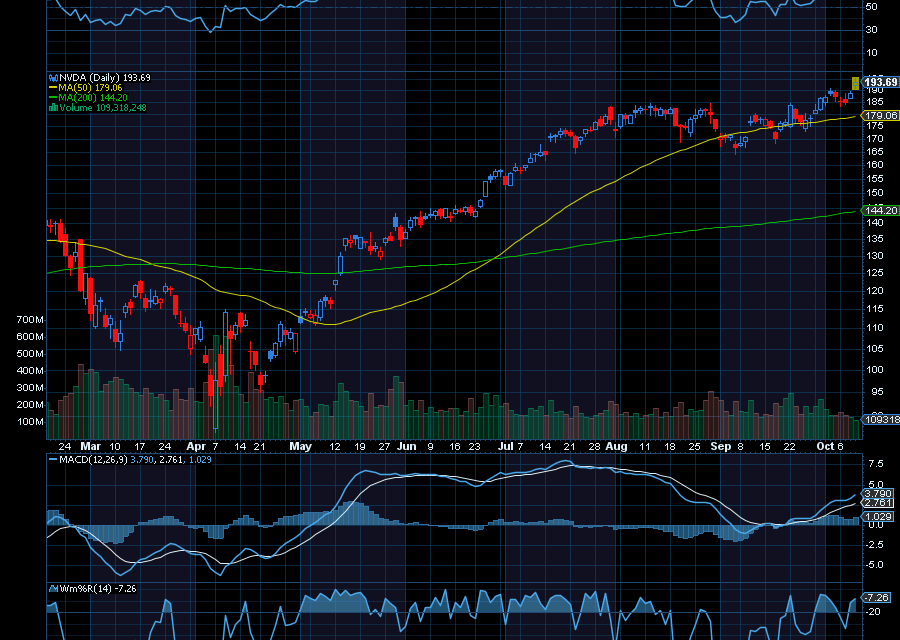

Since bottoming out at around $165 in September, NVDA is now up to $193.64. From here, we’d like to see an initial test of $200 a share.

Sincerely,

Ian Cooper

Recent Comments