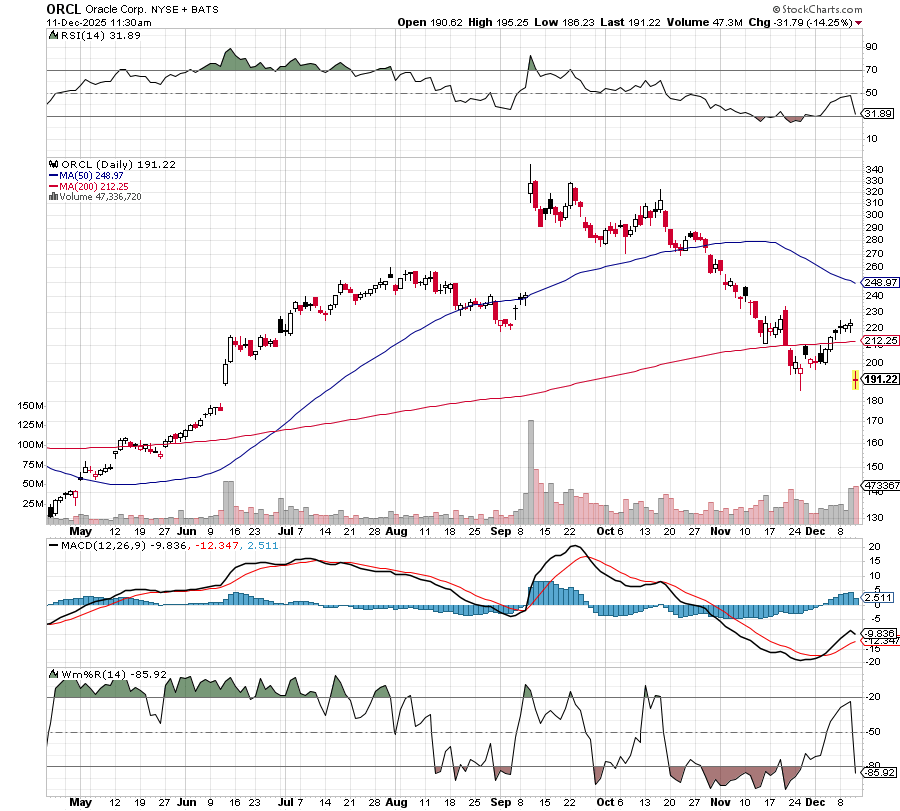

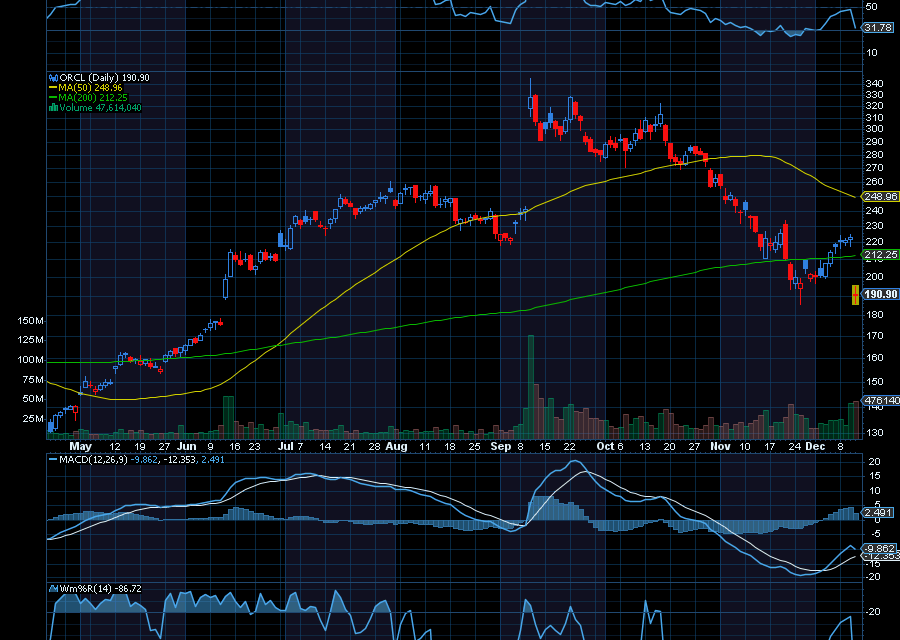

At the moment, Oracle (ORCL) is a falling knife.

So, we wouldn’t buy just yet.

What we’re now waiting to see is if ORCL can hold prior support at $193.60. If it fails at that point, it could slip to $180 worst case. Instead of rushing to buy what appears to be overkill, we’re waiting to see what happens next.

Right now, Oracle is down big after the company posted revenue of $16.06 billion, which is less than the $16.21 billion analysts were expecting. Software revenue was. $5.88 billion, which missed estimates for $6.06 billion.

However, despite the news, analysts are still bullish.

Wells Fargo, for example, has an overweight rating with a $280 price target. Bank of America has a buy rating and a price target of $300. Barclays has an overweight rating with a price target of $310 a share. UBS has a buy rating with a $325 price target.

Sincerely,

Ian Cooper

Recent Comments