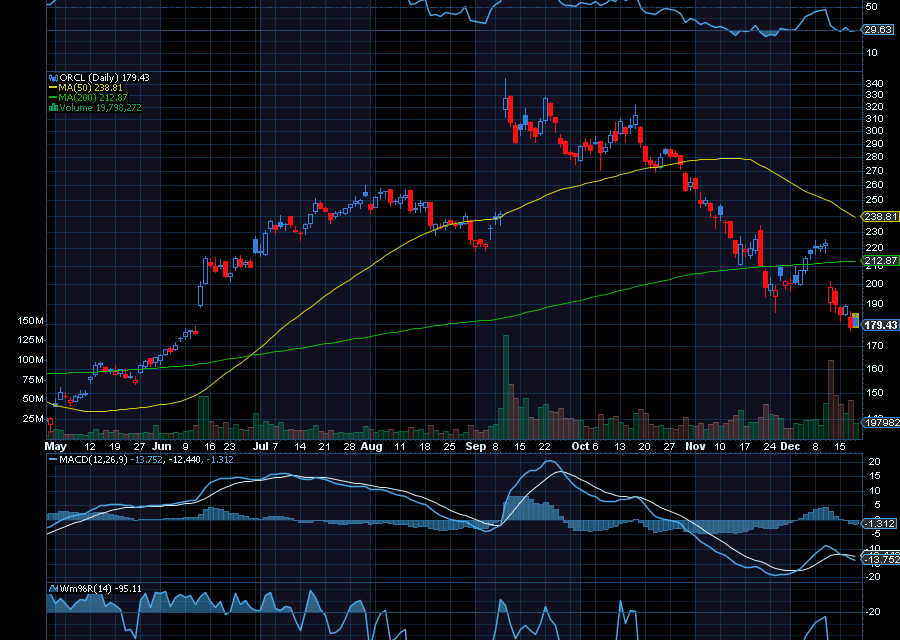

Severely oversold shares of Oracle (ORCL) are showing big signs of life.

After gapping lower on AI data center spending fears, Oracle appears to have caught strong support at $188.65. It’s also overextended on RSI, MACD, and Williams’ %R. From here, we’d like to see ORCL initially refill its bearish gap at around $220 a share. Longer-term, we’d like to see ORCL retest $260 a share.

Fueling upside, Mizuho analysts say ORCL is among its top enterprise stocks for 2026. The firm says 2025 was a “transformative” year for the company, as it went from “an emerging cloud vendor into a key AI infrastructure player,” as quoted by Seeking Alpha.

“We see Oracle as a [long-term] AI beneficiary given its end-to-end stack, including apps, its industry-leading database for mission-critical workloads, and OCI for AI training and inference,” they added. The firm also has an outperform rating on the stock with a price target of $400.

Sincerely,

Ian Cooper

Recent Comments