Always keep an eye on stock splits.

While splits don’t change the value of a stock, they can serve as a positive signal. This can then lead to further liquidity and more investor interest. After all, if an attractive $500 stock were to split 10:1, bringing it to $50 a share, more investors are likely to jump in.

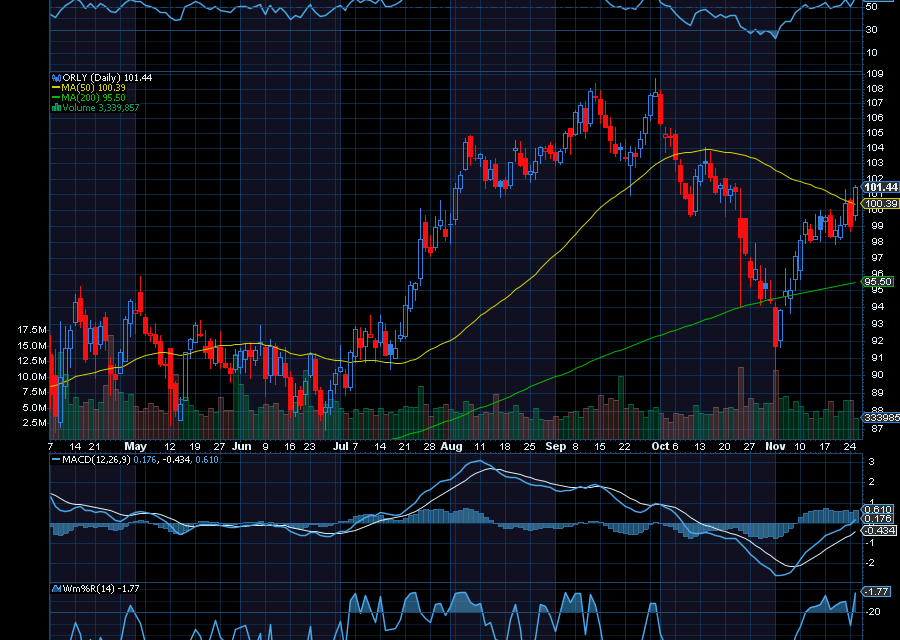

Look at O’Reilly Automotive (ORLY), for example.

At the start of June, it traded at about $1,365 before its 15:1 split.

Today, the stock trades at $100 and is still just as attractive. Goldman Sachs just raised its price target by $13 to $121. Barclays raised its target by $5 to $91. And Raymond James’ analysts just upgraded the stock to an outperform rating, saying ORLY’s pullback was attractive.

Morgan Stanley is also bullish on ORLY, with a price target of $115.

“Our thesis remains intact; we continue to view ORLY as a best-in-class retailer with the ability to continue gaining market share in the structurally advantaged auto parts sector, as evidenced by Q3’25 comps of +5.6% (vs. Street at +4.7%),” they said, as quoted by Seeking Alpha.

Sincerely,

Ian Cooper

Recent Comments