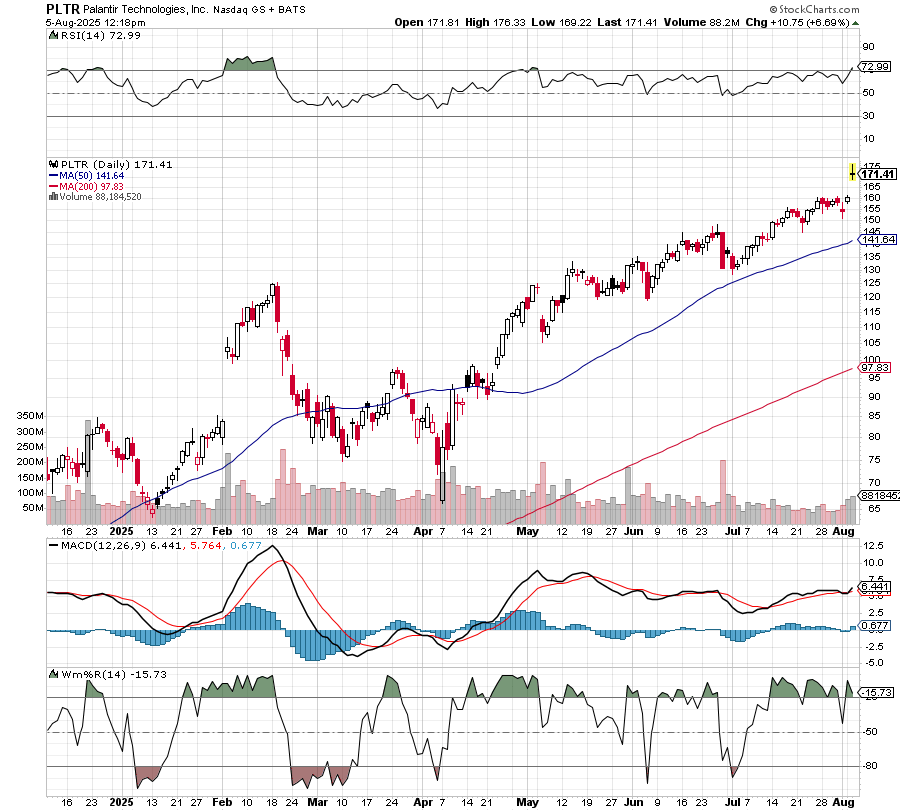

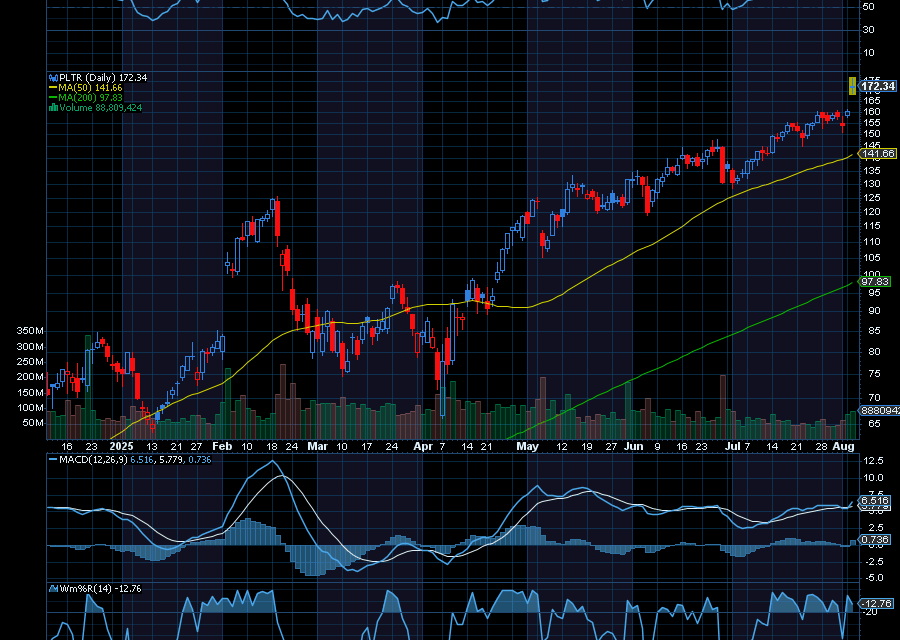

On March 18, we noted that, “Palantir Technologies (PLTR) is coming back strong. After catching support at around $75, it’s now back up to $86.24. Now, if it can break above its 50-day moving average, we’d like to see it retest $100 initially. It’s also starting to pivot from over-extensions on RSI, MACD and Williams’ %R.”

At the time, PLTR traded at about $86. Today, it’s up to $174.70 and could push even higher.

Helping, PLTR just posted EPS of 16 cents, beating by two cents. Revenue of $1 billion, up 47.5% year over year, beat by $60.53 million.

CFO David Glazer stated, “We had an unprecedented second quarter, surpassing $1 million of revenue in the quarter for the first time and delivering our highest Rule of 40 score ever of 94. Q2 revenue growth accelerated to 48% year-over-year, exceeding the high end of our prior guidance by nearly 1,000 basis points,” as quoted by Seeking Alpha.

The company raised its revenue guidance to between $4.142 billion and $4.15 billion. It also raised its U.S. commercial revenue guidance to $1.302 billion, which is growth of about 85%.

Bank of America also reiterated its buy rating on PLTR with a price target of $180. The firm sees Palantir as a beneficiary of rapidly growing demand for AI in commercial and government-end markets.

Sincerely,

Ian Cooper

Recent Comments