We’ve been pounding the table over Planet Fitness (PLNT) since early October.

As we noted at the time, “As millions of us do, we promise next year will be different. Around this time of year, about 90% of us, according to Johns Hopkins Medicine, make a resolution to lose weight, diet, and exercise more. All as millions of us begin to worry about our expanding waistlines, and promise ourselves next year will be different.” Many of us will join Weight Watchers, or even Medifast. Or even join a gym.

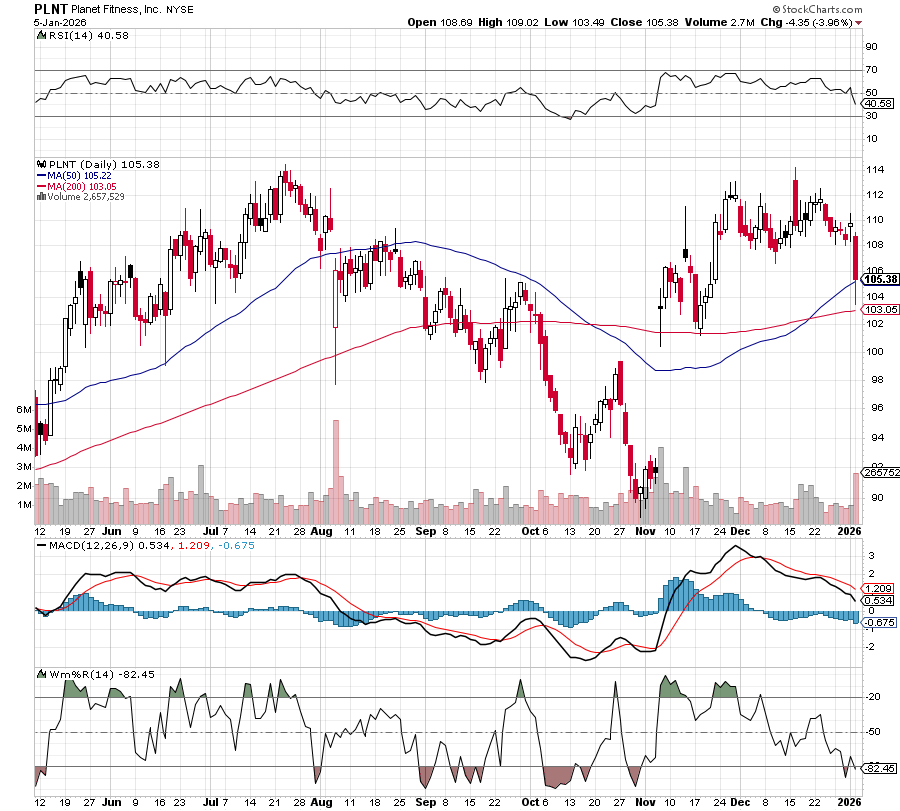

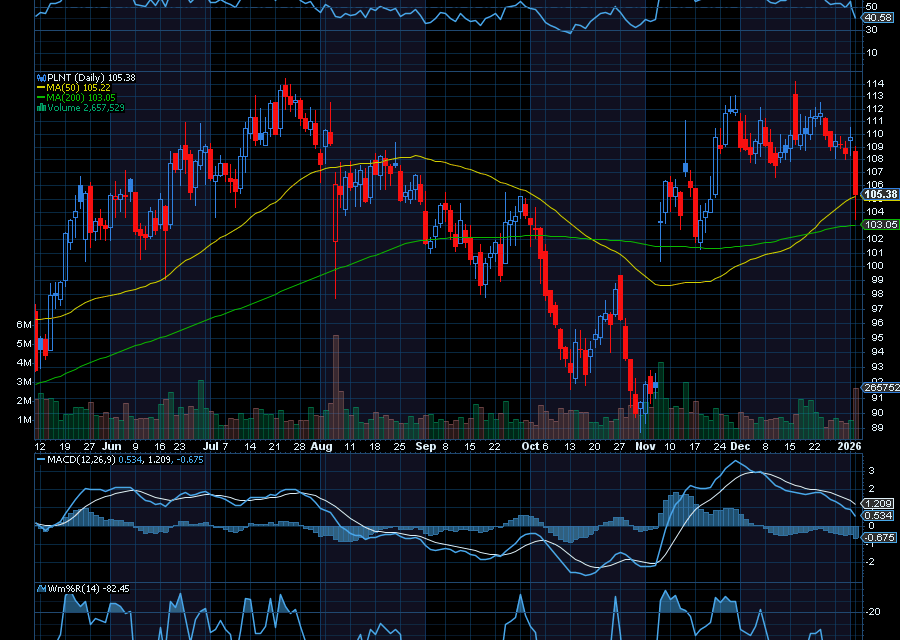

Look at Planet Fitness (PLNT) for example, which we highlighgted at $81 a share.

For the last several years, the stock tends to take off around the holidays. We saw it take off in late 2020, in late 2021, in late 2022, and again in 2023 and 2024.

Today, it’s up to about $110 after hitting a high of about $114 share.

So, again, it did exactly what we thought it would do as a New Year resolution trade.

And by October 2026, we’ll look to buy back into PLNT for another run/

Earnings have also been strong.

Helping, PLNT also posted strong earnings and guidance. EPS of 80 cents beat by six cents. Revenue of $330.3 million, up 13% year over year, beat by $6.87 million.

As for guidance, management raised its 2025 outlook, now expecting same club sales growth of about 6.5%, up from 6%; revenue growth of 11%, up from 10%; adjusted EBITDA growth of 12%, up from 10%; adjusted net income jump to 13% to 14% range, up from 8% to 9%.

Sincerely,

Ian Cooper

Recent Comments