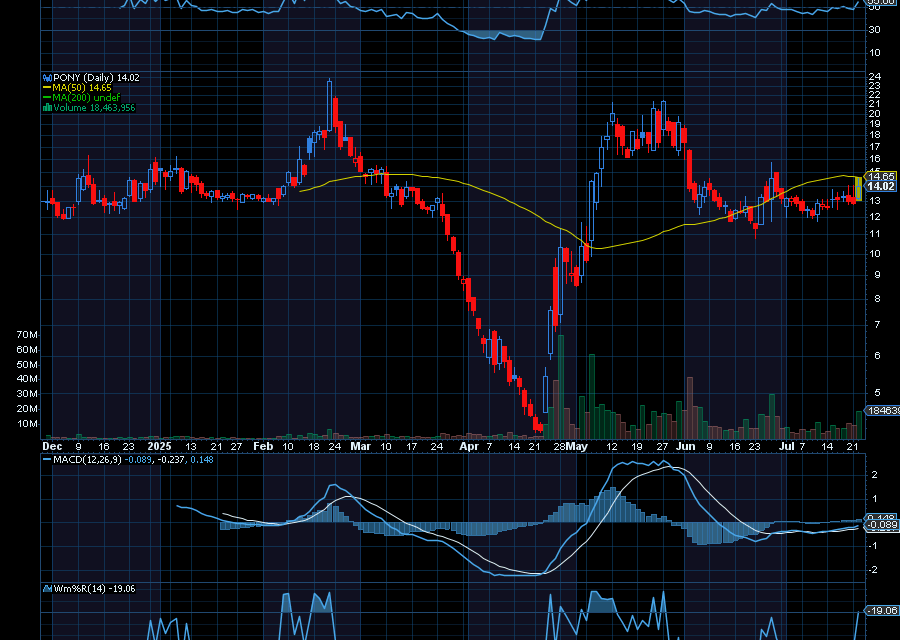

Shares of Pony AI (NASDAQ: PONY) are gaining traction.

All thanks to multiple catalysts.

One, the company just ramped up its Robotaxi mass production and commercialization efforts with the launch of public road testing for its seventh-generation Robotaxis in China, as noted in a company press release. “Targeting 2025 as its ‘mass production year,’ Pony.ai is transitioning from technology demonstration to large-scale deployment.”

Two, the PONY stock was just added to the NASDAQ Golden Dragon China Index, giving it even more exposure to a larger group of investors.

Three, analysts at Bank of America reiterated a buy rating on the PONY stock with a price target of $21 a share. According to the firm, as quoted by Seeking Alpha, analyst Ming-Hsun Lee from Bank of America said, “We believe the cooperation with Xihu Group in Shenzhen, GPTG in Guangzhou, and RTA in Dubai proves Pony’s strong AD technology and adds conviction to its robotaxi fleet size expansion target.”

And four, the company just announced its Level 4 automotive-grade autonomous driving domain controller had surpassed 1.24 million miles of on-road testing.

“Level 4 autonomous driving refers to a highly advanced form of vehicle automation in which a car can operate completely without human intervention under specific conditions or within certain areas,” added Seeking Alpha.

With further progress likely, we wouldn’t be shocked to see PONY at higher highs.

Sincerely,

Ian Cooper

Recent Comments