Three major crypto bills that could send Bitcoin – and related stocks — to the moon this week.

For one, there’s the CLARITY Act, which could provide a framework for the digital assets industry, including defining the roles of the Securities and Exchange Commission and the Commodity Futures Trading Commission (CFTC).

There’s the GENIUS Act, the long-awaited regulatory framework for stablecoins.

The bill, passed by the Senate on June 17, 2025, establishes a framework for issuing and exchanging stablecoins, particularly focusing on consumer protection and market stability.

There’s also the Anti-CBDC Surveillance State Act, which focuses on restricting the use of central bank digital currencies (CBDCs), citing concerns over privacy and surveillance.

Passage could create a stronger upside opportunity for Bitcoin and related stocks and ETFs.

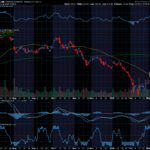

One of those ETFs is the ProShares Bitcoin Strategy ETF (BITO)

If you believe the value of BTC will push higher, you can invest in the Pro Shares Bitcoin Strategy ETF (SYM: BITO).

With an expense ratio of 0.95%, the ETF tracks the performance of spot Bitcoin, according to ProShares.com. As noted by Money, “Like all crypto ETFs, part of the allure of BITO is that investors don’t need to deal with cryptocurrency wallets and private keys but can instead invest through a broker they already use.”

Since bottoming out at around $15 in April, the BITO ETF is now up to $22.72. From here, if Bitcoin can explode higher, as expected, we’d like to see the ETF closer to $30.

Sincerely,

Ian Cooper

Recent Comments