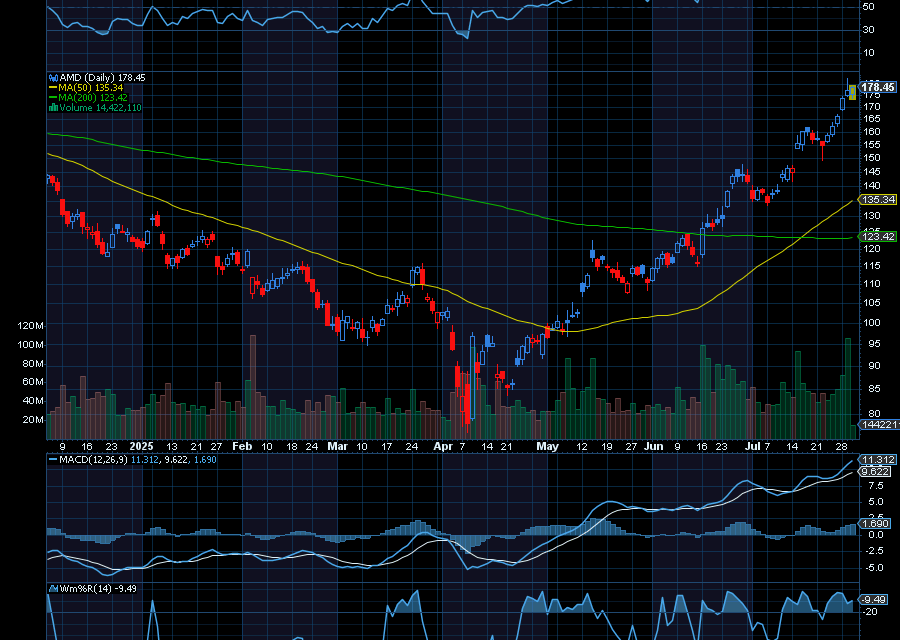

Just last week, we said, “After a brief pullback, shares of Advanced Micro Devices (AMD) are just starting to pivot higher again. Last trading at $157.10, we’d like to see the stock test $175.”

It’s now above that price target – and still rocketing higher.

Fueling that upside are nearing earnings and reports, the company will raise the price of its high-end AI chip, MI350 AI. Plus, analysts at UBS reiterated a buy rating on the stock with a price target of $210 from $150. The firm cited growing demand in both PC and data center markets as key catalysts for AMD moving forward.

Analysts at Morgan Stanley also raised their price target on AMD to $185 from $121.

“The reinstatement of products for the China market has added a new tailwind for AMD/NVDA in the second half, but our enthusiasm is still centered around the level of demand from the core cloud customers,” added the firm, as also quoted by CNBC.

“We see Nvidia as the biggest winner of that spend, but AMD should also see upside in the second half around the Mi350 product cycle as well,” they added.

Heading into earnings, we’d like to see AMD test $200 a share.According to the company, it will report its fiscal second-quarter 2025 financial results on Tuesday, August 5, 2025, after the market closes.

Sincerely,

Ian Cooper

Recent Comments