One of the most successful investors is Warren Buffett.

At the age of 95, he’s now worth about $149 billion.

Typically, when Buffett or Berkshire Hathaway buys a stock, it can lead to increased investor confidence and potentially higher stock prices due to the reputation of the firm, and the longstanding belief Buffett buys quality stocks at a quality price.

If you don’t have much time, but still want exposure to the billionaire’s picks, you can always pick up Buffett-fueled exchange traded funds (ETFs), such as:

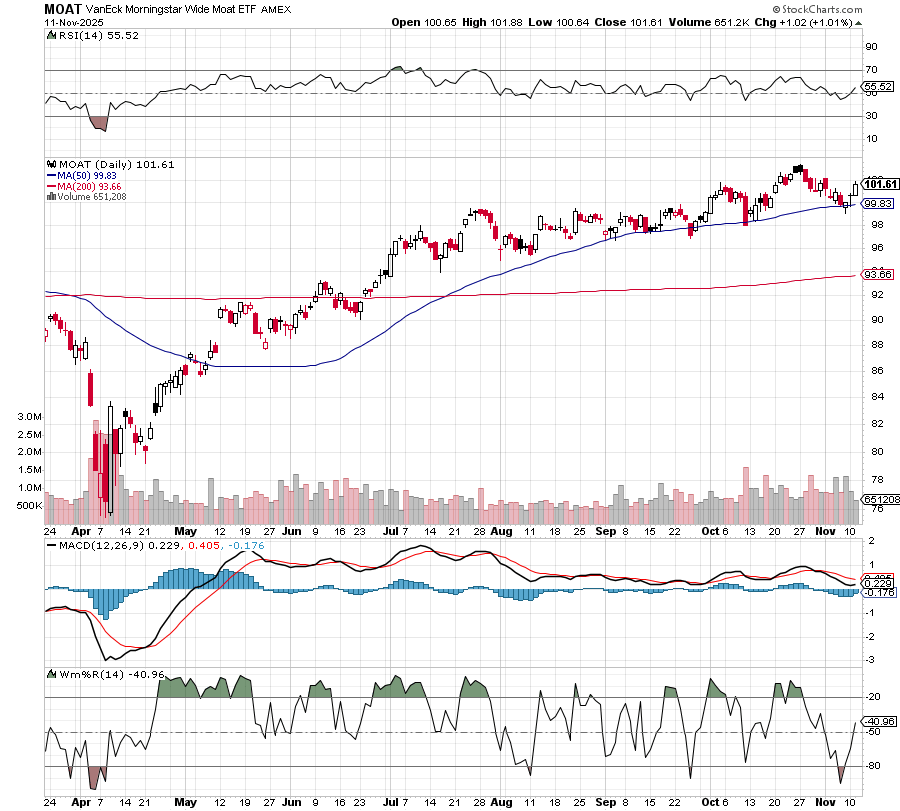

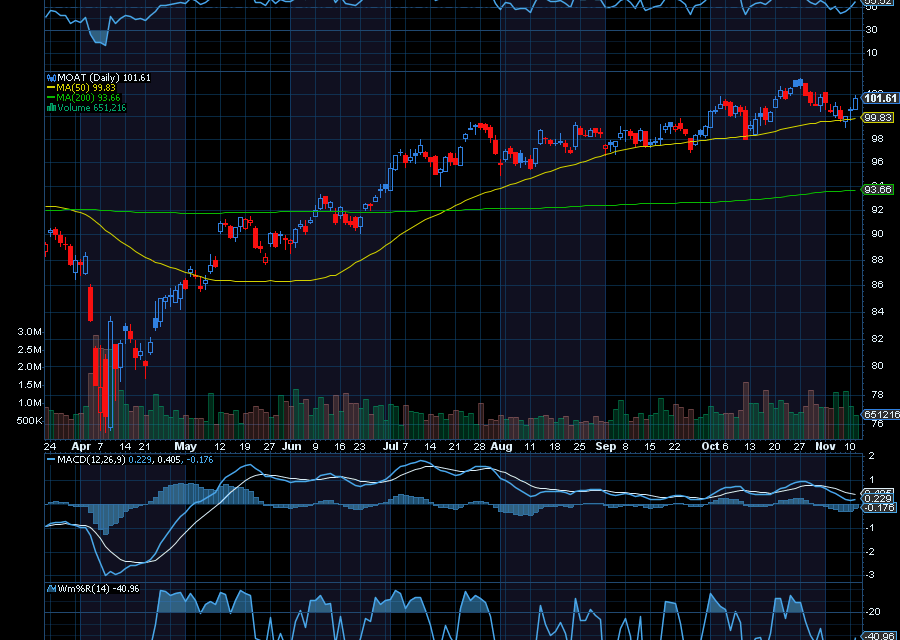

The VanEck Morningstar Wide Moat ETF (MOAT)

If you follow Warren Buffett, you know he likes companies with a wide economic moat.

In fact, if you want to invest in companies attractive to the billionaire, make sure they are:

- Simple companies that are easy to understand

- Companies with predictable and proven earnings

- Companies that can be bought at a reasonable price

- Companies with “economic moat,” or a unique advantage over its competition.

With an expense ratio of 0.47%, the MOAT ETF tracks the performance of companies with sustainable competitive advantages. At the moment, that includes Estee Lauder, Teradyne, Boring, Alphabet, Nike, and NXP Semiconductors, to name a few.

The MOAT ETF also yields 1.33% and pays a yearly dividend. On December 24, it paid out a dividend of $1.2675. On December 22, 2023, it paid out a dividend of $0.7285.

Also, since bottoming out at around $76 in April, the MOAT ETF ran to a recent high of $99.81. From here, we’d like to see it initially test $120 a share.

Sincerely,

Ian Cooper

PS-I have been seeing a very interesting pattern in the charts and it has been very lucrative in the past. I want to show you what I am seeing and how to trade it. I’ll be live this Wednesday at 1PM ET to walk through it. Grab a spot here.

Recent Comments