The FOMC will (likely) be cutting interest rates later today, and all eyes are on what the commentary regarding their view of the US economy does to financial markets.

Additionally, we have a delayed Non-Farms Payroll number coming out on Tuesday of next week.

All of this leads to potential for confusion in the markets, as the VIX presses near recent lows indicating a general lack of fear, but is it justified?

Since it can be tough to find the sectors and stocks that have either a strong investment interest or, at the very least, limited selling interesting, I continue to turn to the Forecast Toolbox!

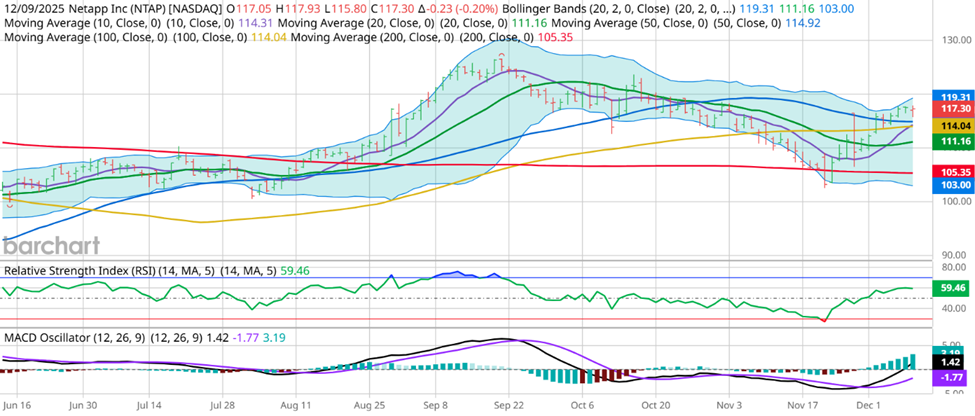

One stock that caught my eye last week was NetApp (NTAP) due to the general technical setup and the Toolbox’s forecast for bullishness, and it appears to have been spot on again:

While NTAP didn’t explode higher, it did enough to run up call verticals or profit on put credit spreads, and that’s a great reminder to me that the AI-generated signals continue to work!

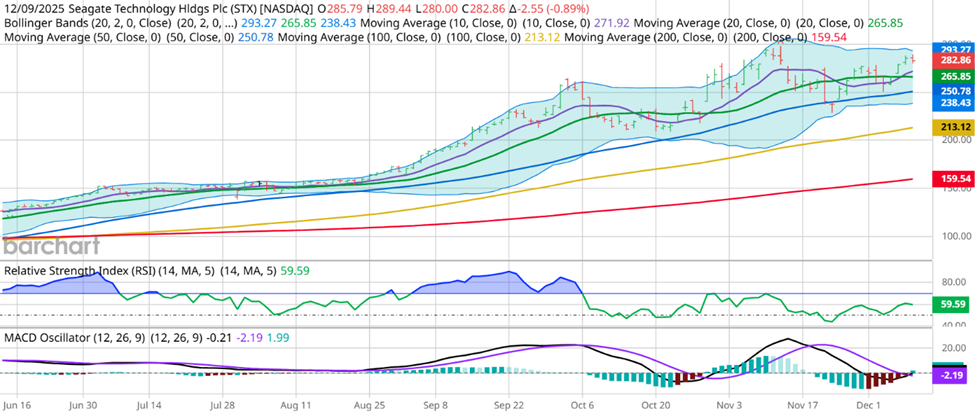

So now I’m looking for another stock and a fresh idea, and an interesting name caught my eye as it’s been on a tear but been consolidating recently, and that’s Seagate Technology (STX):

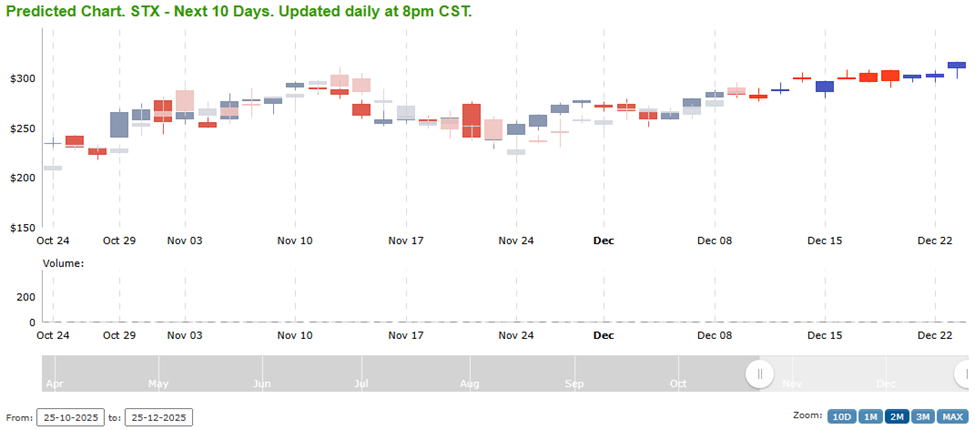

The chart has certainly shown impressive gains over the last 6 months, and while I can’t say for sure that the bullishness will continue in a similar fashion, I am excited by the MACD divergence that recently occurred, giving a bullish signal. Another element I like here is the way the forecast toolbox views the potential for a slower continuation rally in the near term:

Running through the combination of the Toolbox forecast and pairing it with my view that STX should have some technical support in the range of $270 per share, I can take a look at my favorite trading setup in current market conditions: the put credit spread. This is a trade that doesn’t require the stock to go up, it simply has to hold above support. The December 19th, 2025 $270/$267.5 put credit spread is currently trading for about $0.77. While that means I’m risking $1.73 to make $0.77, probability of success is on my side, and with a return on risk of 45% built into that trade, that’s an attractive setup that can compound for long-term gains with a simple short-term view that the stock will not likely go down by more than 4.5% in the next 10 days.

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments