Let’s take a look at how scan for any potential great SPY trades for this week. I am going to share how I look at what the SPY might move this week, an example of a trade to consider using a powerful indicator, and an update on a previous trade. Be sure to scroll down to make sure you don’t miss anything.

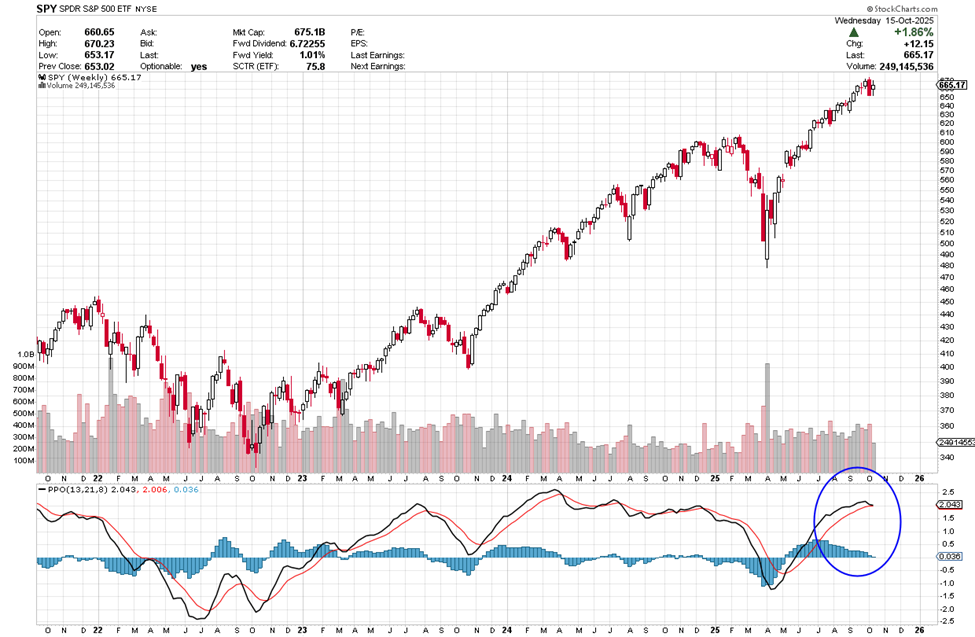

SPY, or the SPDR S&P 500 trust, is an exchange-traded fund that trades on the NYSE Arca under the symbol SPY. It’s an ETF covering companies traded within the SPX Exchange Traded Fund. It trades in high volume which is one of the reasons the Percentage Price Oscillator (PPO) indicator is effective when confirming direction.

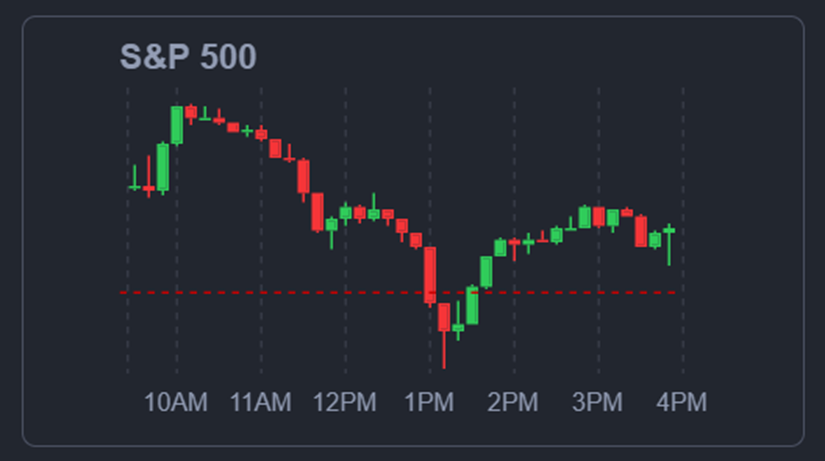

I start looking at the previous trading day to see what the S&P did in terms of price movement.

The image below is Wednesday’s price activity.

This chart image is courtesy of FINVIZ.com a free website and gives a quick view of each day’s movement.

Seeing that chart helps us know what to look for on the next chart that includes the PPO on the bottom of the chart. For more info on the PPO indicator, click here.

When we look at the PPO we are looking for places where the two lines cross. As we look at this example, we see the PPO lines look to be curling over and have almost crossed which indicates a BEARISH move. The stock price in this example is $665.17. A move to 664.50 would be an entry point.

If you were trading options and selected a PUT option strike, you would pay a premium of around $10.48 for the 658 Nov 21st expiration PUT, or $1058 for the 100-share option contract. If the stock price moves to 650 the premium is apt to go up about $5.00. Your premium of $1048 plus $500= $1548. That is a profit of 48% over a short period of time.

This example shows how options can be a very effective way to control risk and maximize potential wins. We know what the premium is before we enter the trade and can determine if it is within our own individual risk tolerance. Using the leverage of options allows us to get the biggest potential return for a smaller initial investment.

Don’t stop here though, I want you to learn as much as possible. Here is a link to a video that talks more about options and how it helped me when I most needed it.

The time you put into learning to trade options will be very worthwhile. Stick with it and believe in yourself.

I wish you the very best,

Wendy

PS-If you want to find out about great opportunities like this, see my articles before they are sent out to the public, and get great updates on the market throughout the day, follow our Telegram channel by clicking here. It make sure you don’t miss any of the great stuff.

Recent Comments