When the financial engine of the economy starts humming again, the stocks that feed it often light up before the broader market notices — and that’s exactly what we’re seeing now. An ETF focused on banking and financial services has surged into a powerful, momentum-driven uptrend, pushing past volatility and now trading at fresh all-time highs. What’s driving the excitement? A rare confluence of healthy credit conditions, thriving capital markets, a steepening yield curve even amid rate cuts, and an economy that’s proving remarkably resilient — all of which create an ideal backdrop for banks to expand net interest margins, grow loan portfolios, and generate robust fee income. With this backdrop and the price action confirming strength, the breakout isn’t just real — it’s accelerating with conviction. This is the kind of trend that belongs squarely on every trader’s radar, because it looks far from done.

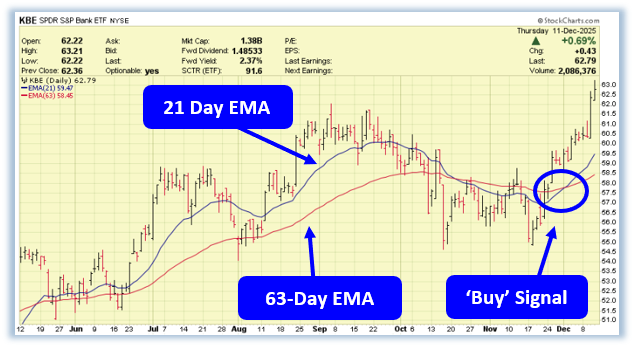

Today’s focus is the SPDR S&P Bank ETF (KBE) — the very fund experiencing this breakout — and it earned its spot on my list for one unmistakable reason: a fresh ProfitSurge Buy signal has just fired. As of last week, KBE’s 21-day EMA has crossed decisively above its 63-day EMA, a move that historically marks the moment when short-term momentum begins overpowering medium-term trend pressure. In plain English: buyers are in control, the uptrend is strengthening, and this breakout isn’t running on fumes — it’s running on acceleration. Layer that signal on top of KBE’s push to new all-time highs, and the setup becomes even more compelling. This is exactly the kind of breakout-in-progress that deserves attention before it becomes crowded.

‼️ Attention Investors and Traders! Curious about Chuck Hughes? Discover the secrets behind 23 profitable years in a row. Get this Ebook now to get started! 💰

Given the strength of this trend, I’m targeting KBE with a slightly in-the-money directional call option, the kind of setup built to fully capitalize if this breakout keeps stretching higher. The chart is sending all the right signals, and if KBE advances just 10% by expiration, this contract projects a 121.4% potential gain — exactly the kind of asymmetric payoff I look for when a bullish move still feels early, not late. And if you want more setups like this — plus weekly education on the technical signals that drive them — now is the perfect time to join our Weekly Workshop video newsletter. You’ll get multiple actionable trades each week, real chart breakdowns, and deeper insight into the tools behind every signal… and right now, the first month is just $1. It’s one of those rare “no-brainer” opportunities in a world where quality research usually costs a premium. If you’ve ever wanted to level up your trading process without overspending, this is the moment to jump in and begin your trial today!

Wishing You the Best in Investing Success,

Blane Markham

Chief Trading Strategist

Have any questions? Email us at dailytrade@chuckstod.com

*Trading incurs risk and some people lose money trading.

Recent Comments