Tech money flow is broadly negative as the markets brace for a potential liquidation trade, and that can scare a lot of people away from long positions.

Much of 2026 has been a pattern of waiting for big tech stock leadership and not seeing it come to fruition. Palantir earnings on Monday after the close looked to change that with a positive move and a potential resurgence of the AI trade, but instead, tech markets sold off and concerns about the market continued.

So, I’m back to a familiar place – looking for stocks that are less impacted and seeing positive money flow without going to the familiar names of the past couple of years. Identifying diamonds in the rough can be a tough task without a filter, but fortunately, I have a great one that continues to find opportunities in an unclear market.

Once again, I’m focusing on stocks highlighted by the Stock Forecast Toolbox to see what ideas look reasonable without feeling like I’m chasing moves or fighting the noise.

One name caught my eye as an interesting candidate that likely wouldn’t have caught my attention without a powerful tool like the Forecast Toolbox, and that’s Urban Outfitters (URBN):

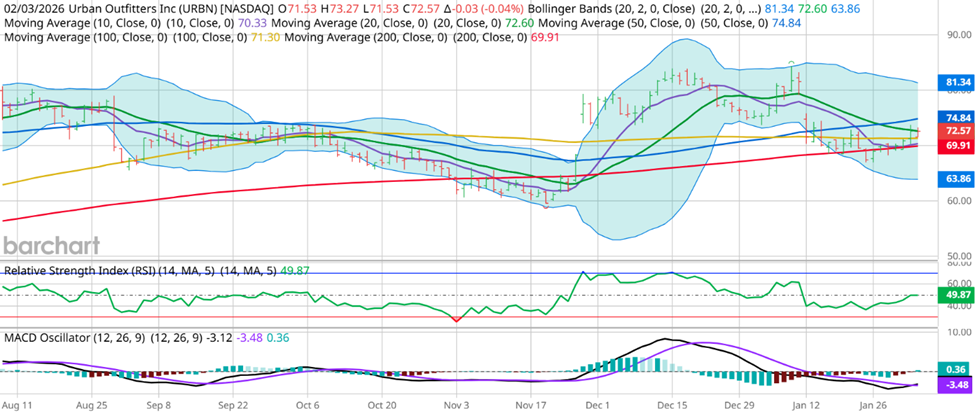

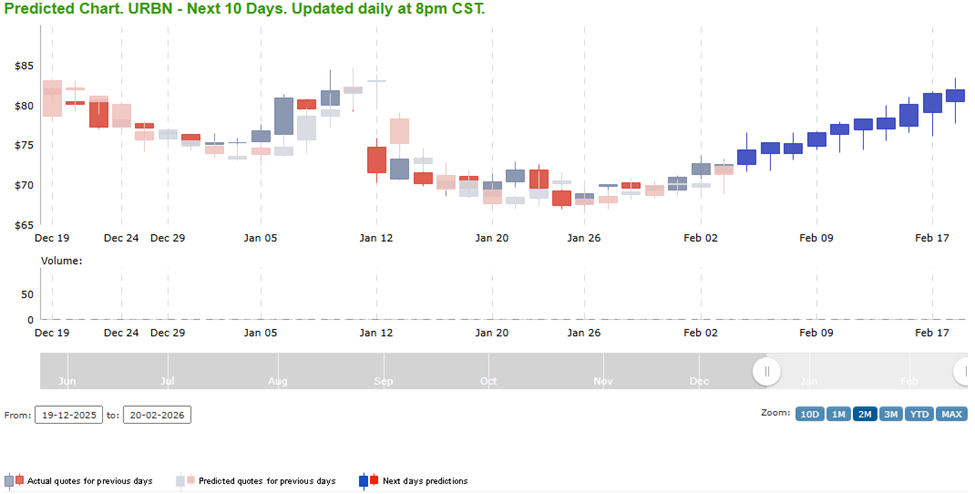

URBN wasn’t immune to drops in the market, but it has found solid support and has been generally immune to dips in the last few weeks. As I see the prices creating a rounded bottom, the upside looks attractive here, and the Stock Forecast Toolbox agrees:

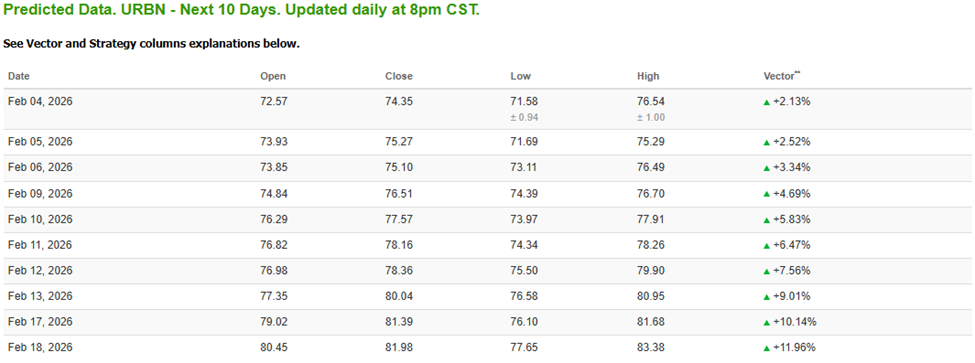

Looking at the AI projected move over the next 2 weeks, there appears to be a high probability of a rally with a projected potential high of over $83. Given the market conditions, I’m worried that a liquidation event could come and create an outsized downside move, so I don’t want to sell a put credit spread this time. Fortunately, the options are priced cheaply enough in the February 20th expiration that if the move to the upside comes about, I can make a big return.

For example, the February 20th $74 calls are currently trading around $2.10, and if URBN rallies to $80, they’d be worth $6.00 or more, so there’s some serious upside here with possible returns around 350% if we reach the target high of $83.38, as the calls would be worth around $9.40 in that scenario!

When I see that kind of potential on an options trade, and current market conditions, I get very excited about positioning with call options!

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments