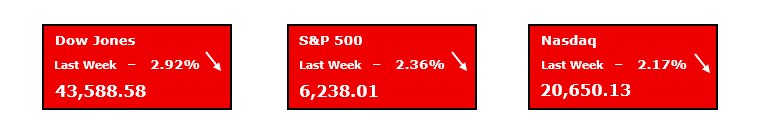

Last week’s trading brought us a halt in the relentless move higher we have been experiencing in stocks lately. Entering the week, broadly, stocks were already trading in short-term overbought territory with both the S&P and Nasdaq opening the week trading outside the upper Keltner band. Of course, as we know, this did not hold for long. Headed into last week, we had warned that it was chock-full of significant market moving events, so much so that it even had the potential to overwhelm some investors. The rubber really began to hit the road with these events on Tuesday with the “JOLTS” report indicating further slowing trends in hiring and available jobs in the U.S. labor market. Building on this, Wednesday’s Fed meeting delivered the expected result, the FOMC opting to leave rates unchanged, albeit the decision was not unanimous. But what really moved markets here was Fed Chair Powell’s press conference, following the rate decision. Powell took quite the hawkish tone and really poured cold water on the idea that rate cuts were upcoming given the data up until that point. The dashed hopes for a September rate cut quickly turned stock prices lower as many equities had begun to rally on hopes of a cut at the next meeting. This hawkish tone from Powell brought about a great deal of selling pressure on stocks throughout the mid-part of the week. Fortunately, the major earnings that were due last week actually posted solid results on average. Now, the stock reactions were not positive across the board, however, the Q2 financial results were encouraging. Additionally, the Q2 GDP report and June PCE reports both delivered good and in-line results, respectively. Each of these combined with the strong earnings results gave stocks a boost in early trading on Thursday, before the gains ultimately faded into the close as hopes for a September cut had all but dissipated. However, in Friday’s trading, stocks extended their leg lower in this current pullback after the July Job’s report was released. This report was a major miss to the downside. While is still showed a luke-warm 73K jobs were added in July, unemployment ticked up by 1/10th and more importantly, the previous two month’s number of jobs added were revised down massively, indicating burgeoning weakness in the U.S. labor market. This report is truly what spooked investors and caused stocks to sink to round out the week. Despite the strong earnings & GDP, this signal that there could be some economic deterioration occurring, in the mind of investors, this outweighed all the positives especially given that stocks were trading at all-time highs headed into the week. We did see treasury yields and interest rates fall, and odds of a Fed rate cut in September spike on Friday, however, all of this occurred for the wrong reason, so it was not supportive for stocks. We had warned in prior weeks that as stocks continued to levitate higher, setting new highs consistently, that eventually investors were going to look for a reason to take profits and send stocks lower in the short term, this very weak jobs report delivered exactly that.

After the late week rout in stock prices, it is more important than ever to take a read on the market technicals & internals to see what they can tell us. Several things are clear from the start. First, is that we saw significant deterioration in many breadth indicators last week. The S&P 500 Advance/ Decline line experienced a significant drawdown, and the Equal Weighted S&P 500 actually broke through it’s 50-Day MA to the downside. Furthermore, now 7 of the 11 SPDR sector ETFs have now cracked their own 50-Day MA to the downside as well. This is all further evidenced by only 55% of S&P stocks now trading above their 200-Day MA, so many stocks reversed trend last week. The second thing that is clear, is that a very distinct divide in this market is forming between a group of ‘Haves’ and a group of ‘Have-nots’. What I mean by this is the stocks that have a reasonable connection to the A.I. narrative and those that do not. If you look at what is still working, it’s any stock that plays a role in the A.I. buildout, whatever it may be. Then if a stock does not have this connection, it simply is not working. Of the remaining SPDR sectors that are above their 50-Day MA, they are XLK, XLC, XLI, & XLU. In fact, the Utility sector ETF, XLU, was the only of the SPDRs that rose last week. This marks a significant narrowing in this market, right at the moment when we were getting some good signs of breadth increasing. This will be a key dynamic to watch for in the weeks to come to see if we can begin to regain the broad participation. However, in the meantime, each of these four sectors are still displaying strong relative strength in a narrowing market. All this said, after last week’s steep and quick drop, several layers of support are now going to come into play, which could help to buoy stock prices as traders begin to grapple with them. The first few levels will be the S&P 500’s 50-Day MA & around 6150.

⚡ Special Promo: First Month Access for Only 1$⚡

Have you joined my Weekly Profit Opportunity newsletter yet? If not, then you just missed out on a recent trade alert I sent to members that has risen 117.4% in just a few weeks! While past results do not guarantee future returns, this newsletter features my top trade pick each week!

Key Events to Watch For

- Trade Policy

- Q2 Earnings Reports Continue

- U.S. Treasury Yields Falling

Even in a jam-packed week, last week investors were closely monitoring the newswire for any trade deal announcements in advance of the August 1st deadline set by the administration. There were a handful of deals announced prior to the deadline, with the most significant being with South Korea. Numerous other countries that were unable to strike new deals had fresh tariff levels announced on Friday. Additionally, negotiations are still ongoing with several major trading partners of the U.S., namely China, Mexico, & Canada. Expect trade deal developments to continue to be a big story for markets until final deals are made with all of the major trading partners of the U.S.

Last week was a massively important one for markets, in part, due to the high volume of crucial earnings reports that were on deck. As the earnings reports came in, it was clear that while the reactions to the reports were certainly mixed, the actual numbers that were being reported were quite strong compared to the estimates. Virtually all of the major companies that reported last week beat EPS numbers handily. As we sit with roughly 2/3rds of S&P 500 names having reported earnings now, a healthy 82% of them have posted upside EPS beats, which is great! In addition to this, the actual EPS growth rate for these companies, as of now, has been quite strong too. This is a great sign for stocks despite the mixed reaction from investors to these reports. This week, earnings will continue to roll in with several key names on tap to report this week. A few of the most notable names scheduled for this week are the high-flying Palantir (PLTR), Advanced Micro Devices (AMD), Caterpillar (CAT), & Uber Technologies (UBER). Even though PLTR shares have exploded higher this year, analysts are expecting their earnings to follow suit. The expectation is that when the company releases results after the closing bell on Monday, they will report 55.6% YoY growth in Q2 earnings, an impressive number for anyone.

On the heels of last week’s underwhelming July Job’s report that spooked markets, much attention will be focused on Treasury yields this week. The yields on U.S. Treasuries plunged in Friday’s trading as uncertain investors sought out the traditional ‘safe haven’ trade. Of course, falling yields can be beneficial for stocks, however, if they are falling for the wrong reason, then this potential tailwind for equity prices is largely moot. Investors will continue to assess the fallout from the Job’s report and the action in yields will be a key indicator to watch. If they continue to trend down from here, this would signal that investors are perhaps more concerned with the state of the U.S. labor market and the economy as well. Watching bond yields this week will be a key read on investor sentiment.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments