When fear creeps into the market, money doesn’t sit still—it moves fast toward safety and opportunity. Right now, one of the clearest beneficiaries of that rotation is the gold mining space, where fiscal policy uncertainty, stubborn inflation, and mounting geopolitical tensions have converged to fuel a powerful surge. With the price of gold pushing higher, the companies that dig it out of the ground are seeing that strength flow straight to their bottom lines—and the charts are lighting up with momentum. This is not just a blip on the charts—it’s an unmistakable breakout that traders need to have squarely on their radar.

The name at the center of this breakout is the VanEck Gold Miners ETF (GDX) — the premier basket of leading gold mining stocks. With gold prices surging to fresh all-time highs, miners like those inside GDX are positioned to reap the rewards in a way few other industries can. Add in the backdrop of policy uncertainty, sticky inflation, and intensifying global tensions, and it’s no surprise that capital is flooding into this trade. Investors aren’t just chasing shiny headlines here—they’re leaning into a sector with strong fundamentals, rising profitability, and technicals that confirm momentum is accelerating. GDX has become a go-to vehicle for traders who want direct exposure to the gold rush unfolding right now.

⚠️ Attention Investors and Traders! Curious about Chuck Hughes? Discover the secrets behind 23 profitable years in a row. Get this Ebook now to get started! 📈

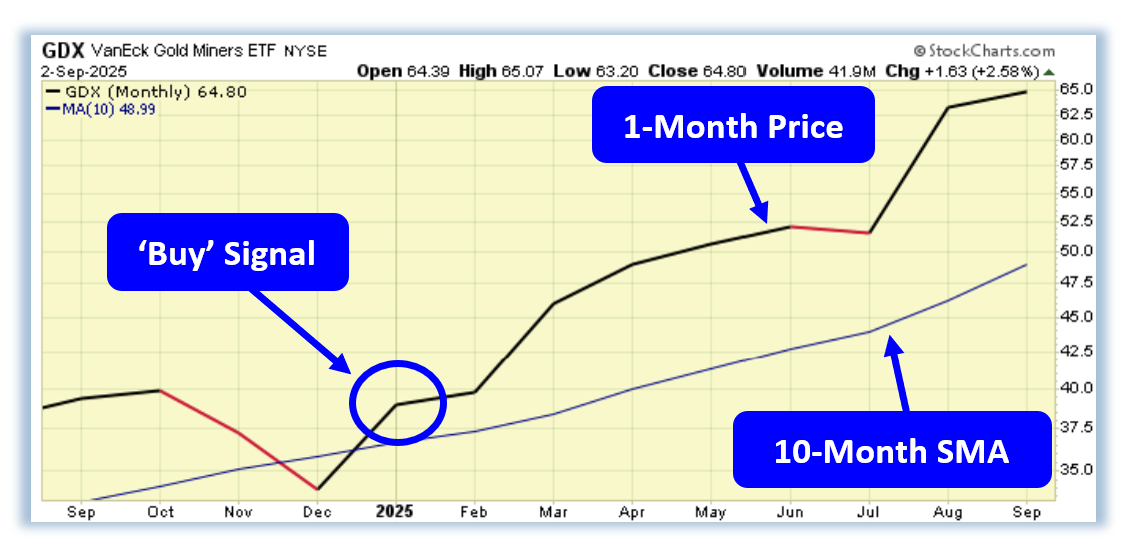

What takes this setup from interesting to must-watch is the technical confirmation flashing across the charts. GDX has triggered what I call a PowerTrend ‘Buy’ signal—its 1-Month Price pushing above the 10-Month SMA. This isn’t some minor blip, it’s a tried-and-true momentum filter that has consistently identified the early stages of powerful, sustained moves. When a sector ETF like GDX clears this hurdle, it’s a sign that institutional capital is pressing the gas, and history shows that ignoring it can be costly. Breakouts of this caliber don’t come around often—and when they do, they tend to run a lot farther than most traders expect.

That’s why for this setup on GDX, I’m eyeing an ITM call debit spread—the technicals and momentum are strong, the breakout looks poised to continue, and using a spread gives me the built-in buffer I want. With GDX options carrying rich premiums, this strategy works in our favor: at current prices, there’s a call spread offering a 53.8% profit potential even if shares are up, flat, or down as much as 7.5% at expiration. That kind of risk/reward balance is exactly how I like to stack the odds in my trade setups.

And if you want more trades ideas like this, our Optioneering Newsletter is where you need to be. Each week we deliver multiple actionable setups—built on the exact technical methods I’ve outlined here—and right now you can get your first month for just $1. That’s four weeks of trade alerts for a single dollar. If you’re serious about leveling up your trading, this deal is a no-brainer. Tap the image below to get started today!

Wishing You the Best in Investing Success,

Blane Markham

Chief Trading Strategist

Author, Trade of the Day

Have any questions? Email us at dailytrade@chuckstod.com

*Trading incurs risk and some people lose money trading.

Recent Comments